Business Insurance in Pennsylvania: Costs, Benefits, & Who Needs It?

According to the Bureau of Labor statistics, US employers reported over 2.7 million workplace-related injuries and illnesses in 2020. If you think about how many employees missed work because of injuries, you can only imagine how affected business operations were, even for a short time.

Besides employee injuries, other factors impact your business operations, including:

- Customer injuries

- Professional negligence

- Natural disasters.

These incidents can result in expensive lawsuits that are quite difficult to handle without business insurance.

But what’s the best business insurance for you? How much does it cost? What is required?

In this article, you will find everything you need to know about business insurance in PA.

What is Business Insurance PA?

Business insurance (also called commercial insurance) in PA protects businesses from losses. These risks and losses include coverage for damage, legal liability, and employee- and customer-related injuries.

For example, if a customer falls inside your business premises, they could take legal action and file a lawsuit against you. Without Pennsylvania business insurance, you could pay steep legal fees, and you already know how dangerous these unpredicted financial hits can be.

Why Do I Need Business Insurance in PA?

Small business insurance in PA is important when protecting your business and when things go well. Here are a few reasons how the right business insurance policy in PA can help you:

- Win more clients: In most cases, big clients require business owners to carry errors and omissions insurance or professional liability insurance. People who hear you have these policies are more likely to trust you.

- Comply with state laws: Business insurance is required in almost all states in the US.

- Cover expensive legal bills: Many small businesses face lawsuits at least once during their operations. The right insurance policy can protect you from costly legal bills.

- Cover data breach damages: Data breaches can jeopardize your business. With cyber liability insurance, you can cover ransom payments and other recovery costs.

- Cover your business vehicles: Commercial auto insurance can cover damages and liability like personal auto insurance.

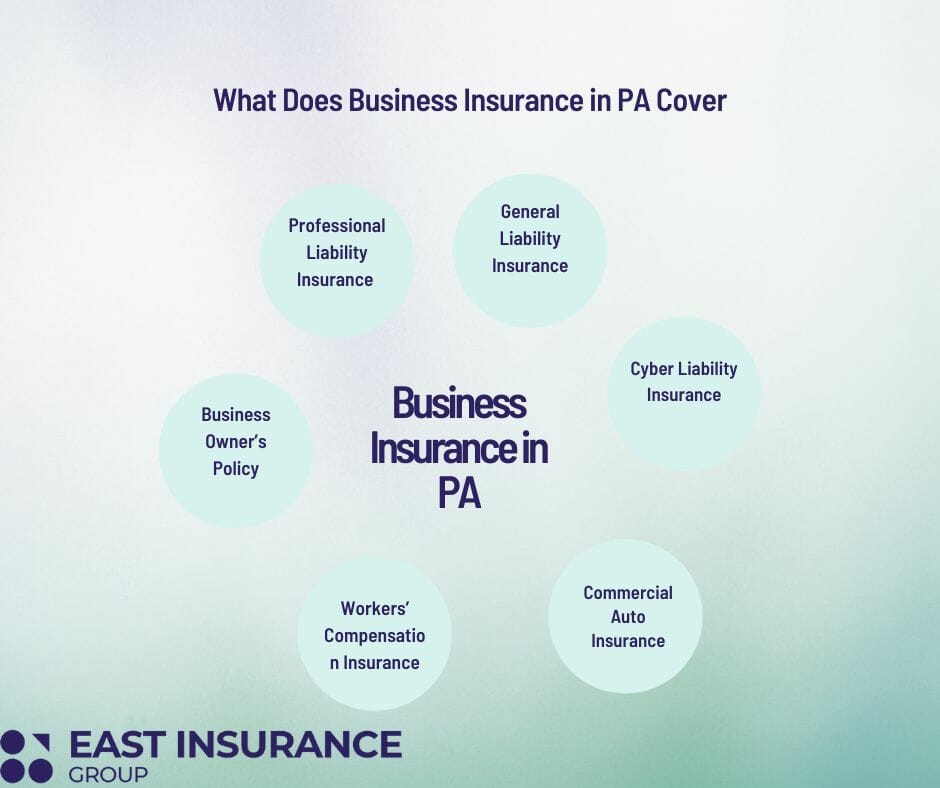

What Does Business Insurance in PA Cover?

If you’re looking for business insurance in cities like Philadelphia, PA, you can get coverage for certain things.

General Liability Insurance

The general liability insurance in PA policy is important because it protects businesses against frequent third-party risks.

Professional Liability Insurance

The professional liability insurance policy, also known as errors and omissions insurance or E&O, covers lawsuits related to business operations.

Cyber Liability Insurance

The cyber liability policy covers financial losses that result from cyberattacks and data breaches. If you own a business in PA that works with credit cards and personal data, you should consider purchasing this policy.

Business Owner’s Policy

A business owner’s policy includes commercial property insurance and general liability insurance. A BOP is often considered the most cost-effective type of business insurance in PA.

Workers’ Compensation Insurance

Workers’ comp insurance is required for any PA business that has employees.

Commercial Auto Insurance

Commercial auto insurance is another type of policy required in Pennsylvania for all business-owned vehicles. Commercial vehicle insurance in PA is useful because it covers property damages and injuries, vandalism, and weather damages.

Do I Need Business Insurance in PA?

According to the state laws in Pennsylvania, there are two types of insurance policies that are required for all businesses:

Workers’ Compensation Insurance

Regardless of the employment type, all PA employees are covered by workers’ comp insurance. The policy covers medical bills and provides disability benefits.

Commercial Auto Insurance

All vehicles driven for business purposes in Pennsylvania must have commercial auto insurance. Minimum requirements for auto liability insurance in Pennsylvania are:

- Bodily injury liability: $15,000 per person / $30,000 per accident

- Property damage liability: $5,000 per accident

- Medical benefits: $5,000

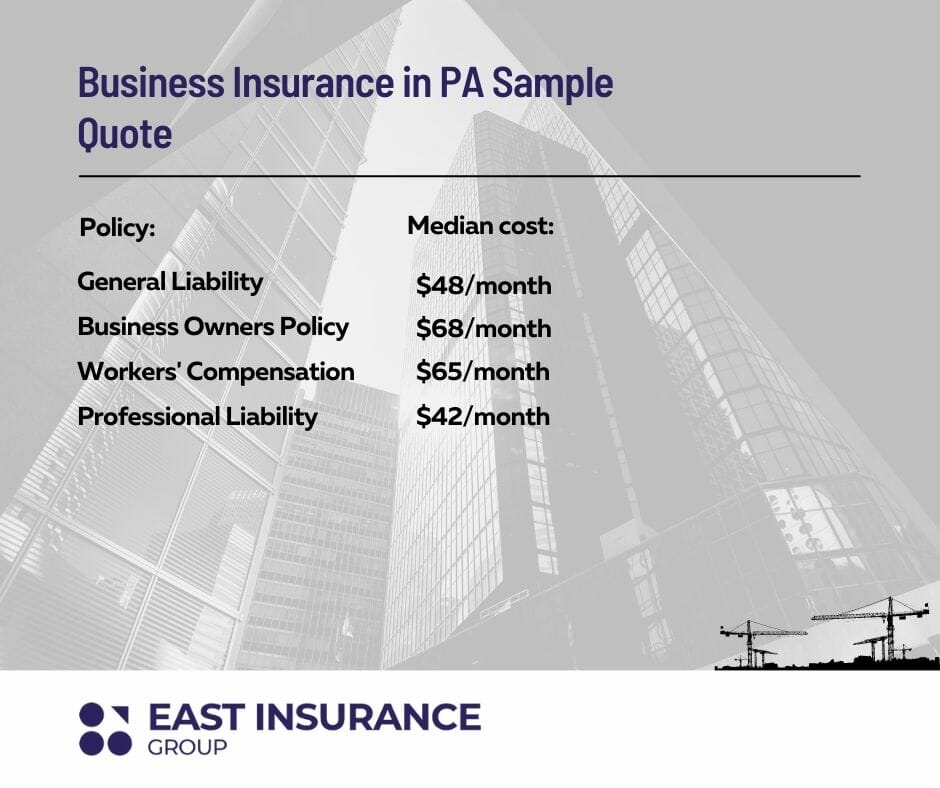

How Much Does Business Insurance Cost in PA?

Pennsylvania’s median business insurance price is typically around $47 per month. The cost of business insurance in PA depends on several factors, including:

- Industry

- Coverage needs

- Size

- Location

- Business profession

Industries and professions that work with heavy equipment and face bigger risks will usually pay more for coverage.

Who Needs Business Insurance in PA?

All businesses should consider having commercial insurance in Pennsylvania to protect them from unpredictable risks, but some professions need more coverage than others, including:

- Contractors

- Restaurants

- Bakeries

- Cleaning Services

- Hair Salons

- Manufacturers

Is Event Insurance Important For Your Business?

Event insurance is important for your business as a short-term policy that covers public (book launches, movie screenings, award ceremonies) and private events (birthdays, baby showers, weddings). The policy is especially useful when covering bodily injuries and property damages, as well as protecting your investments in the events you organize. Event insurance covers:

- Event cancellation

- Event liability

- Liquor liability

- Food liability

Where Can I Find Business Insurance in PA?

East Insurance Group offers policies in all cities in Pennsylvania, including:

- Scranton

- Pittsburgh

- Philadelphia

- Erie

- Reading

- Bethlehem

So if you’re looking for business insurance in cities like Pittsburgh, PA, you can reach out to us. When you choose East Insurance Group, you choose expertise and a professional approach that provides your business the flexibility you need to adjust your insurance policy according to your specific needs.

Are you still confused, or do you need some help getting a business insurance in PA quote for your business? Contact us today and get all the information you need fast and for free!