Everything You Should Know About Commercial Auto Insurance NY

Most people know how important individual car insurance is. However, if you are a business owner in New York, you should probably consider having commercial car insurance as well. Even if your business doesn’t own vehicles, cars used for business purposes should be covered by a commercial policy.

If you use your personal car to conduct business, the insurance company probably won’t cover any accidents, bodily harm, or property damages that result from the business use of your car. As a business owner, you could end up open to claims against your business.

Here’s everything you should know about commercial auto insurance in NY.

What Does Commercial Auto Insurance NYC Cover?

Commercial auto insurance in New York is usually a mix of required and optional coverage in one policy. This type of policy may include the following coverage, depending on your needs:

- Commercial Auto Liability: This type of commercial car insurance in NY provides coverage for amounts that you are legally required to pay for others for injuries or property damage from a covered accident.

- Uninsured Motorist: This type of policy covers you or your employees if you are injured in a covered accident caused by a negligent uninsured driver.

- Medical Payments: This type of coverage pays for the necessary medical treatments for you or your employees.

- Comprehensive Insurance: This type of commercial auto insurance in NY pays for damage to your commercial vehicles for covered losses including damages caused by wind, hail, earthquake, glass breakage, flood, theft, vandalism, and fire.

- Collision: This type of insurance pays for damage caused to your commercial car that resulted from an accident with another car, or a covered collision with something else, for example, a tree.

- Personal Injury Protection: Personal injury protection (PIP) covers injuries, death, loss of services and loss of income.

- Hired Non-Owned Auto: This type of coverage provides liability coverage for vehicles you don’t own that are used by other employees in your company.

- Loading and Unloading: This type of coverage provides liability protection for damages that result from loading onto or unloading from covered vehicles.

- Towing and Labor Costs: This type of coverage covers necessary towing charges, according to your commercial auto policy, in case your commercial private passenger car breaks down.

Why Do I Need Commercial Auto Insurance in NY?

New York commercial auto insurance is important because you cannot use personal auto insurance to cover a commercial vehicle.

The State of New York requires a separate policy for vehicles used for business purposes, even if they already have personal coverage on them.

Also, if one of your business vehicles gets in an accident, you could face a lawsuit or settlement. In this case, commercial car insurance in NY could cover damages to the other vehicle or property, medical costs, lost wages, and pain and suffering costs.

How Much Commercial Auto Insurance in NY Do You Need?

In New York, basic liability coverage is required for commercial vehicles. However, if you want to be sure your commercial auto coverage pays for damages and injuries in case of an accident, you should discuss the best options for your type of business. One of the best ways to do that is to talk to an experienced insurance specialist who will craft the right amount of insurance according to your specific needs.

How Much Does Commercial Auto Insurance In NY Cost?

On average, drivers in New York pay $3,433 per year for their full coverage. The cost of commercial auto insurance in NY is much higher compared to other states in the US, which makes it one of the most expensive insurance premiums in the country.

When it comes to commercial auto insurance quotes in NY, there are several factors that affect the cost of the auto policy, including:

Industry

Because some industries carry more risk than others, the cost of commercial auto insurance in New York varies depending on your profession.

Vehicle

The size of your car also affects the rates of your commercial auto insurance in NY. Large, heavy trucks will have a higher premium than smaller vans and delivery trucks.

Check also commercial truck insurance in NY.

Driving History

Insurance companies run reports on all drivers with access to your commercial vehicles. Drivers with more accidents on their driving records will also have higher rates. Typically, insurance companies take the past three years into account.

Location

Commercial auto insurance rates are usually higher in large cities like NYC. Also, prices are higher in locations that have more claims or more expensive settlements, including areas with more floods and wildfires.

Coverage Needs

The amount of coverage you need impacts the price of your commercial auto insurance.

In the past few years, the average cost of commercial auto insurance has increased across the US. When it comes to New York, several factors impact this increase, including highway density, driver demographics, and extreme weather.

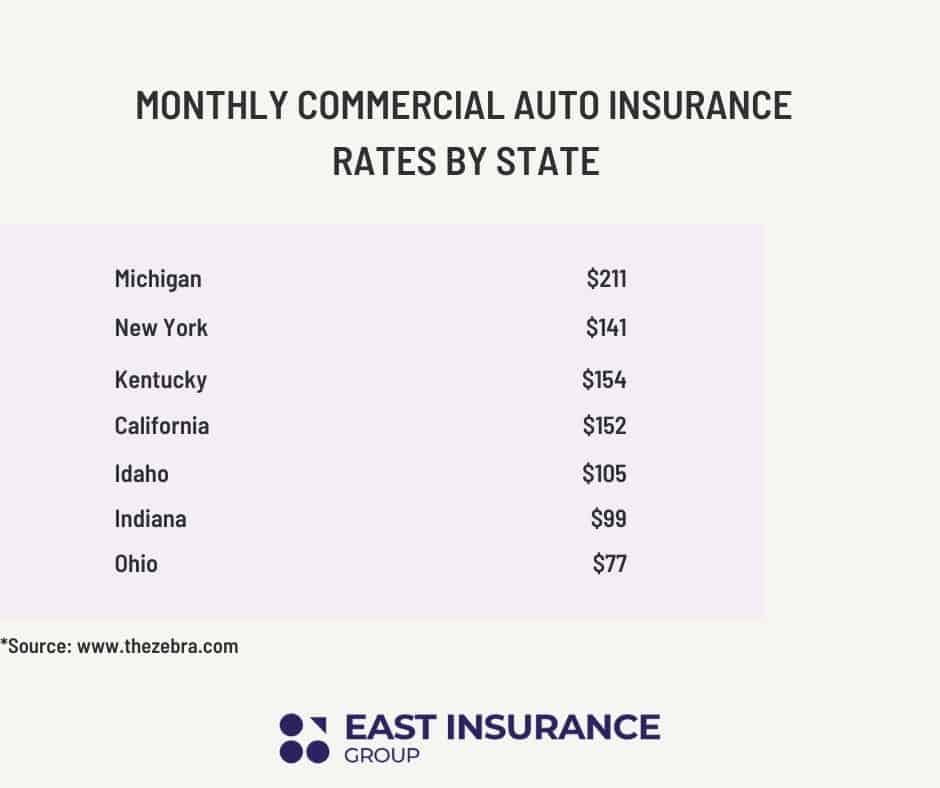

To understand the difference in commercial auto insurance quotes, see the list below with average monthly car insurance costs:

Is New York a No-Fault State?

The State of New York has no-fault insurance in terms of car coverage. In general, this means that your insurance policy will cover you if you get into an accident.

At the same time, the other person’s insurance will cover them, no matter who’s at fault for the accident. If you want to purchase auto insurance, New York has minimum insurance requirements that must be met if you own a vehicle.

Minimum Commercial Auto Insurance Requirements in New York

- A $10,000 property damage liability

- A $50,000 basic no-fault coverage plan

Keep in mind that bodily injury liability varies. For example, there’s a $25,000 injury liability requirement with a limit of $50,000 per accident.

In the unfortunate case of death, it’s a $50,000 per-person liability and $100,000 cap per accident. The rules change if you don’t own your vehicle outright. For example, if you have an auto loan from a lender, then state law may require you to purchase higher insurance that is above the minimum.

How to Get Cheap Commercial Auto Insurance in NY?

Despite the cost of minimum car insurance, it is still possible to get cheap auto insurance in New York. In fact, if you are looking for inexpensive and affordable auto insurance, New York has some affordable insurance firms.

Furthermore, you want to shop around the area to see if you can find the best deals. Also, remember that when it comes to rules regarding auto insurance New York State requires that any business selling insurance must be appropriately licensed to do business in the state.

When you contact an insurer, don’t be afraid to ask about discounts with deals. There are some standard discounts that may be available. These include discounts for students, spotless driving records, and multi-line policies. There may also be discounts that are unique to a particular car insurance provider.

There are also other things you can do to help keep your car insurance costs down.

You want to ensure that your vehicle is up-to-date with the latest safety features. This can include installing an anti-theft alarm system and break proof windows.

Other things you can look out for is making sure your car passes the emissions test and that childproof locks are installed.

Also, cars that are regularly parked on the street carry much higher insurance rates than those stores in garages. So having a safe place to store your car or vehicle can equal big savings down the line.

Another way to lower your insurance cost is to take a driving safety course. Once you have a certificate from the course, you will be able to present it to auto insurers.

The Bottom Line

Commercial auto insurance in NY is an option you should definitely consider if you or your employees drive vehicles for business purposes, regardless of whether you own, lease, or use personal cars. Although the insurance quotes are higher compared to other states, there are still ways to get cheaper insurance.

Confused about commercial auto insurance in NY, or need some help getting a quote for your business? Call us or fill out a quote request form and get all the information you need fast and for free!