Landlord Insurance Costs in 2023: Details and Coverage

Landlord insurance doesn’t have a set price, as it will depend on your specific business.

How much does landlord insurance cost?

The average cost for landlord insurance can be around $1,300 annually or around $100 per month. The true cost of rental property insurance all depends on a wide range of factors, however. In this article, you’ll learn all those factors and more.

What is Landlord Insurance?

No matter what you consider an investment venture – whether leasing or renting out your unoccupied house- you should consider buying insurance protection.

However, you should also remember that the more you spend on your insurance, the lower the profit you’ll gain.

In this article, you’ll learn ways to lower rental property insurance costs.

As a landlord, earning less than what you’re supposed is the last thing you want. But things don’t have to be this way since many representatives and underwriters will help you shop and compare numerous landlord insurance policies and prices from different insurance providers.

With their professional guidance and assistance, you can avail of the appropriate home insurance coverage for your own set of needs at the most affordable cost. There is no need to struggle with the dilemma between landlord insurance and your profit.

Now, you will spend less money on insurance and earn more income from your investment venture – it’s that easy. But before you get overwhelmed with all ins and outs of policies, here’s a brief introduction to how insurance companies calculate the landlord insurance costs and prices of certain policies.

Landlord Insurance Calculator

Insurance companies consider many risk factors when it comes to estimating the cost of insurance for rental property, such as the location and size of your rental property and the affiliated expenses for replacement or repair. After that, they add all the aspects according to your unique set of needs, add a dash of profit margin, and there, you’ve earned yourself a quoted premium that is specifically curated for you.

When answering, how much for landlord insurance? It would help if you also noted that, for the most part, the rental home insurance costs will be consistent until the lifespan of your landlord policy. However, several things could change it, such as upgrades to the value of your property, filing a claim, or during the case that the financial demands of your plan dramatically escalate and trigger the insurer to increase it.

Many factors impact the quote of your landlord insurance policy. Generally, when an insurer preps your policy, here are the things that they are considering:

- Dates and purchase costs for all your rental properties

- Underlying or present property insurance policies and any claim history records

- Locations of every rental property you own; some places in the country are more costly to insure than others.

- Improvements, upgrades, and renovations are carried out to the properties, even those that are made by renters – built-in shelves, additional rooms, etc.

- Square footage of every unit

- Safety equipment and tools installed on the premises of the property – motion sensors, burglar alarms, trained guard dog, or fire sprinkler systems

For example, landlord insurance in Florida may cost about $2,300 per year, which would be different from landlord insurance in NJ.

Types of Landlord Insurance

Depending on your needs, there are three types of landlord insurance:

DP-1

This is the most basic type of coverage and the least expensive one. DP-1 is a comparatively limited policy. It names the events covered, such as lightning, fire, explosions, wind, and hail damage. Usually, DP-1 policies cover real cash value, though some pay out value to replace it as well.

DP-2

DP-2 policies have more dangers than DP-1 policies. Common inclusions are listed in DP-1 policies, including situations such as burglary damage, snow, ice damage, water damage, and collapses. DP-2 policies might not protect you if the unit has a long vacancy (suggesting a lack of proper care).

DP-3

DP-3 is the most extensive landlord insurance policy. The policy covers all dangers except some exclusions, such as damages caused by war, floods, earthquakes, neglect, and intentional action. Generally, DP-3 policies pay out the cost to replace the insured items.

How to Save Money on Landlord Insurance

Landlord insurance costs can be significant, especially if you have several rental units to insure. Luckily, there are several options that can help you save money:

- Eliminate high-risk features such as hot tubs and pools

- Add security protections such as carbon monoxide and smoke detectors

- Purchase insurance policies in bundles

- Consult an experienced insurance specialist

- Think about raising your deductible

How Much Does It Cost to Insure a Rental Property?

The average home insurance costs $1,000 per year. The average premiums, on the other hand, range from $600 up to $2,300.

How much is landlord insurance? Typically, landlord insurance costs more than other forms of coverage since it has greater liability and bigger structures. Expect that you’ll pay 20% more for insurance on rental property’s cost per year than you would for homeowners insurance. This means that rental property insurance will cost about $1,300 a year.

How much is landlord insurance per month?

Unfortunately, landlord insurance costs don’t have an average price. Prices fluctuate dramatically based on several factors. It also varies according to the state, country, city, and even block where the property is situated. Apart from this, the price also varies according to the different kinds of rental properties that you have. These include:

- Single-family home

- Condo unit

- Multi-family (three to four-unit) house

- Two-family home

- Retail

- Industrial

- Office

- Apartment building (five-plus rentals)

How Much Insurance Do I Need for My House?

When you have the right insurance in place, you can protect yourself from major financial losses that could damage your real estate career. It is essential that you find the sweet spot between being cash-poor and insurance-rich.

You want to guarantee that the amount of money you are paying for insurance premiums alone will not wreak havoc on you and your business. It pays to work with a reputable insurance company to meet your present situation and needs. Here are tips for different kinds of landlord insurance that will suit your rental property.

- Liability insurance: You can buy liability coverage to protect the physical property of your rental unit and your actual business.

- Hazard and fire insurance: This will protect you if your rental property is damaged by fire and other unforeseen accidents.

- Sewer backup insurance: This additional policy can be added to your underlying hazard and fire insurance policy at an affordable price.

- Flood insurance: This is mostly beneficial for rental properties that are located in a designated flood zone area. Also, even if your property is not situated in a designated flood zone area, but you are worried that extreme flooding might damage your property, you can buy flood insurance.

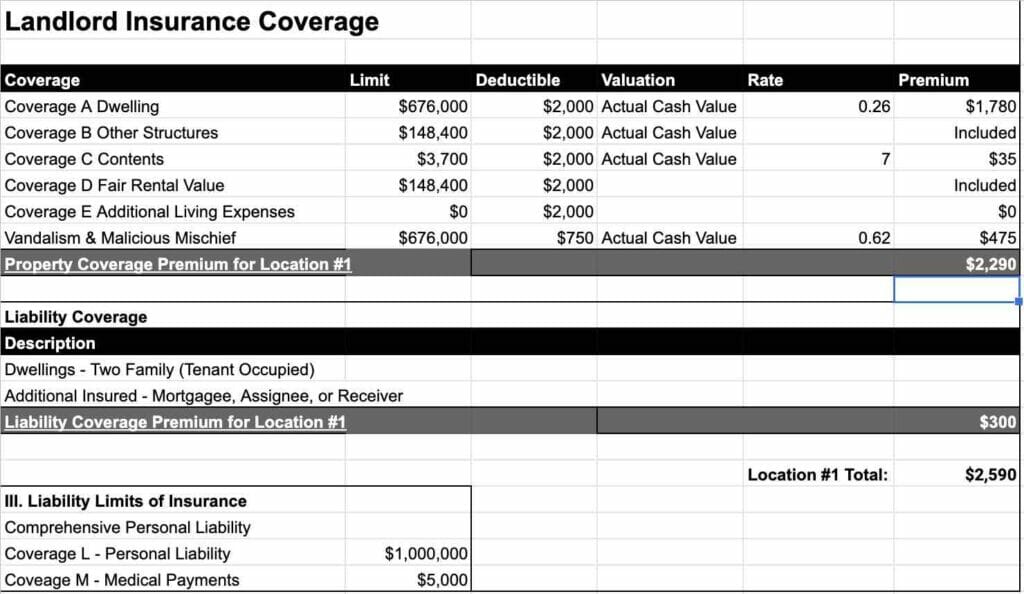

A Real World Landlord Insurance Example

Let’s say you have a 3,700-square-foot apartment building with three rental units near downtown Chicago. It was sold for $950,000 in 2018, and the owner believes its replacement cost would be around $740,000 at $200 per square foot, which brings a monthly rental income of $6,000.

After reviewing several insurance quotes, the owner purchases landlord insurance for $2,590 per year.

Here’s a useful breakdown of the policy:

- Dwelling: $676,000 limit and $2,000 deductible

- Other structures: $148,400 limit

- Personal property: $3,700 limit

- Vandalism: $676,000 limit

- Fair rental value: $148,400 limit

- Personal liability coverage: $1,000,000 limit

- Medical payments: $5,000 limit

Homeowners Insurance Cash Value vs. Replacement Value

Landlord liability insurance costs about 15% more than traditional homeowners insurance. While homeowners insurance only protects your personal property and dwelling, landlord liability insurance covers personal liability and medical for the guests and residents.

Landlord insurance also covers your if income is lost if rent can’t be collected. Or if you as a landlord are sued when a resident or guest injures themselves.

Items Normally Not Covered by Landlord Insurance

While each landlord insurance policy is different, there are certain exclusions that are the same for most of them, including:

- Equipment malfunctions

- Partial rentals (such as a room or an attic tented to a tenant while the rest of the house is occupied by the owner)

- Tenant belongings

Read More: Does Landlord Insurance Cover Tenant Damage?

Most and the Least Expensive States for Landlord Insurance

The Insurance Information Institute found that the most expensive states for landlord insurance in the US are:

- Lousiana ($262 per year)

- Georgia ($243 per year)

- Mississippi ($228 per year)

- Kansas ($225 per year)

- Alabama ($222 per year)

The least expensive states, on the other hand, are:

- Wyoming ($101 per year)

- Iowa ($110 per year)

- Vermont ($110 per year)

- North Dakota ($116 per year)

- Pennsylvania ($116 per year)

What Does Landlord Insurance Cover?

Being a landlord is an incredible way to earn a generous amount of passive income; however, it can also be extremely expensive when things go out of your control.

Since you allow strangers to live on your property, you are exposing yourself to various risks.

Aside from your tenants, it would help to watch out for vandalism and natural disasters that can potentially damage your property. All in all, being a landlord is a challenging job that you should take seriously if you want to succeed in real estate.

Of course, you don’t have to do all the work alone. Landowner insurance is a great option if you plan to protect your personal property and yourself from possible risks and damages. You can talk to an independent representative or underwriter, and ask for their professional help and expertise. They are well-versed with the ins and outs of landlord insurance and liability protection, and they will walk you through the entire process.

One thing that you should pay attention to is the home insurance coverage amounts that you need. Your insurance representative will help you choose the best and most appropriate homeowners’ coverage that you need to protect your property.

The following tips include different types of coverage that you should consider:

- Liability coverage: This will secure you if someone damages or harms your property. It can be a tenant or guest.

- Property damage: This will secure your homes from buildings, sheds, pools, gym, lounge area, and other structures, including your fixtures and equipment.

- Workers’ compensation: This will safeguard you and your maintenance staff in case someone is injured while on the job or has suffered from a medical condition caused by their line of work.

- Loss of income: This will guard your finances and reimburse you if your property is uninhabitable for a certain period.

- Natural disasters: This will provide coverage against unforeseen harsh weather conditions like floods or earthquakes.

- Legal fee coverage: This will guard you if your tenants try to sue you. It will cover your legal fees and other expenses because protecting yourself in court isn’t cheap.

Do I Need Landlord Insurance and Homeowners Insurance?

Landlord insurance works by securing property owners and their properties.

If your property gets damaged by accidents, theft, natural disasters, and other risks, your insurance company will cover all the expenses until you can operate on your own again. It will help you get back on your feet during unforeseen property damages that could lead to financial downfall.

You might be thinking that you still don’t need that insurance because your tenants are good people, and they aren’t capable of suing you or damaging your property.

However, it pays to be ready for unpredictable circumstances. At this point, anyone can sue you for anything – even your renters. Talk to your insurance representative to get the best insurance for landlords for you.

Read More: The Ultimate Guide To Business Renters Insurance

How Much Dwelling Insurance Do I Need?

Dwelling Insurance in your homeowners insurance policy covers the costs of replacing the actual structure of your home. You can determine the amount of dwelling coverage you need by calculating the cost of rebuilding your home and any attached structures such as the front porch, plumbing, roof, in-ground swimming pool, or garage.

Dwelling insurance is most likely the highest coverage limit in your homeowners insurance policy as it pays for rebuilding your entire home using current construction, materials, and labor costs.

How to Calculate Dwelling Coverage

To calculate a quick estimate, call your local home construction company or a real estate representative to find out the current costs of rebuilding a home and multiply that number by the square footage of your home.

Remember that, even with the best estimate of coverage costs, your dwelling coverage limit may still not be enough if you file a claim to rebuild your home. To avoid this, consider adding extended replacement cost coverage to your existing landlord insurance policy that will pay you an additional amount (usually 25% or 50% of your dwelling limit) toward rebuilding costs.

Why is My Landlord Insurance So Expensive?

The average cost of landlord insurance is expensive because it provides a much wider range of protection, compared to homeowners or renters insurance. The payout is much larger with landlord insurance than other types of insurance.

Is Landlord Insurance Tax Deductible?

Yes, because you are a business owner, landlord building insurance counts as a business expense. That means you can deduct the cost of premiums from your taxes.

Does Landlord Insurance Cover Windows?

It may be in some situations. If the window was broken on purpose, the tenant’s liability insurance might cover the repair. And if the window broke due to neglected maintenance, then your insurance probably won’t pay for the coverage. However, broken windows during a storm are usually covered after the deductible is met.

And if you are interested in discovering more about insuring your commercial property, read about how East Insurance Company makes insurance easier!