Contractor Insurance: Cost, Benefits, & Who Needs It

Contractors have many occupations. They supply equipment, labor, and professional services at the client’s premises. Contractors are also responsible for coordinating the project, which often includes assessing project documents and determining the site for renovation projects. Interior decorators, carpenters, plumbers, electricians, and roofers are just some of the contractors people hire these days.

Because they use so many different tools regularly, contractors need the right coverage for the equipment they keep carrying around for business purposes. One of the most cost-effective ways to get contractors’ property and commercial general liability coverage is to buy a Business Owners Policy (BOP) that is crafted according to their needs.

For example, you are remodeling a client’s kitchen, and faulty plumbing leads to property damage. You could end up having to pay thousands of dollars for this mistake. Contractors insurance could protect you from this, and many other risks contractors face during the normal course of business.

So what’s contractor insurance? Contractor liability insurance can cover your business needs from the risks of your job. Contractor insurance usually includes several types of policies that can protect you from accidents, lawsuits, theft, damages, and even lost income.

Because every business has specific needs, commercial contractor insurance can range from standard contractor insurance policies to a more detailed mix of coverages. The type of contracting business you own, its size, and its location are some of the most common factors that affect the type of contractor insurance coverage you may need.

In this article, we will explain what contractors liability insurance covers, how much it costs, who needs it, how to save money on policies, what’s the difference between a certificate holder and an additional insured, what are the requirements for contractors insurance, and more.

Because every business has specific needs, commercial contractor insurance can range from standard contractor insurance policy to a more detailed mix of coverages. The type of contracting business you own, its size and location are some of the most common factors that affect the type of contractor insurance coverage you may need. Here’s what you need to know before you make a decision.

What Does Contractor Insurance Cover?

Quality insurances for contractors usually include several types of business insurance policies that protect your business from various problems and risks. The coverage types depend on your specific business needs. Here are some of the most common contractor insurance policy coverages:

Contractor Property Insurance

The BOP policy is useful as it offers coverage for your business’s real estate and other properties. If you rent or lease, the BOP covers the tenant’s improvements, including:

- Fixtures

- Alterations

- Installations

- Additions that can’t be legally removed from the premises

When it comes to the biggest risks of personal property loss, contractors face losing valuable equipment and machinery that is not covered by the standard equipment insurance and that they move around from job to job. This type of property can be insured by contracts called “floaters.”

Floaters cover various types of machinery and equipment during installation and transit. Usually, this type of coverage is provided for machinery that contractors install, such as heating and air conditioning. Still, it can also cover other items wherever they are used, such as hand tools and power drills.

Read more: The Ultimate Guide of Handyman Insurance

Contractor Liability Insurance

Given the possibility of a lawsuit should someone claim to have been harmed by your work. You will almost certainly need professional liability insurance for contractors. Contractors insurance is usually a bundle of insurance policies that cover your business in case someone files a claim against you.

In most cases, contractors need commercial auto and workers’ compensation insurance. You might need other types of coverage depending on the size of your company and what type of work you do.

If you are a subcontractor, your clients may require you to carry Owners’ and Contractors’ Protective Liability coverage or OCP. OCP covers a business owner or a general contractor from liability that may arise from negligence acts.

Business Vehicle Insurance For Contractors

Personal vehicle coverage doesn’t provide coverage for vehicles used for business purposes. If you own a truck and drive it for business purposes, you must have a business auto policy to cover you in case you get in an accident.

If you don’t have commercial auto insurance and your personal auto policy doesn’t have enough coverage to pay all the damages, a lawsuit may be filed against your business. Therefore, discuss your business needs with an experienced insurance specialist is recommended.

Contractors Workers Compensation Insurance

If your business has three or more employees, you may be required to carry workers’ compensation insurance. These requirements vary from state to state, so it might be a good idea to check with your state department whether your state requires you to purchase workers’ comp insurance.

This type of commercial contractor insurance policy covers the employees of a company in case they are injured while working. Often, this is the most expensive part of insuring your business.

Builder’s Risk Insurance

This type of liability insurance for contractors covers property and materials that are used during the project. Typically, this type of policy is bought for new construction projects and remodeling.

Business Interruption Insurance

In case you have to close your business due to an issue that is covered by your policy (for example, theft or fire), this type of business insurance for contractors can help you replace your income.

Read more: The Ultimate Guide to Construction Insurance

Does a Subcontractor Need Contractor Insurance?

Having business insurance is always a good idea, even if the law doesn’t require it from you.

Every business should protect its services, goods, and workforce, even if they are just starting out. And that includes subcontractors too. It would be best to keep in mind that insurance can help you land more significant projects. After all, many contractors require insurance if you are going to work for them.

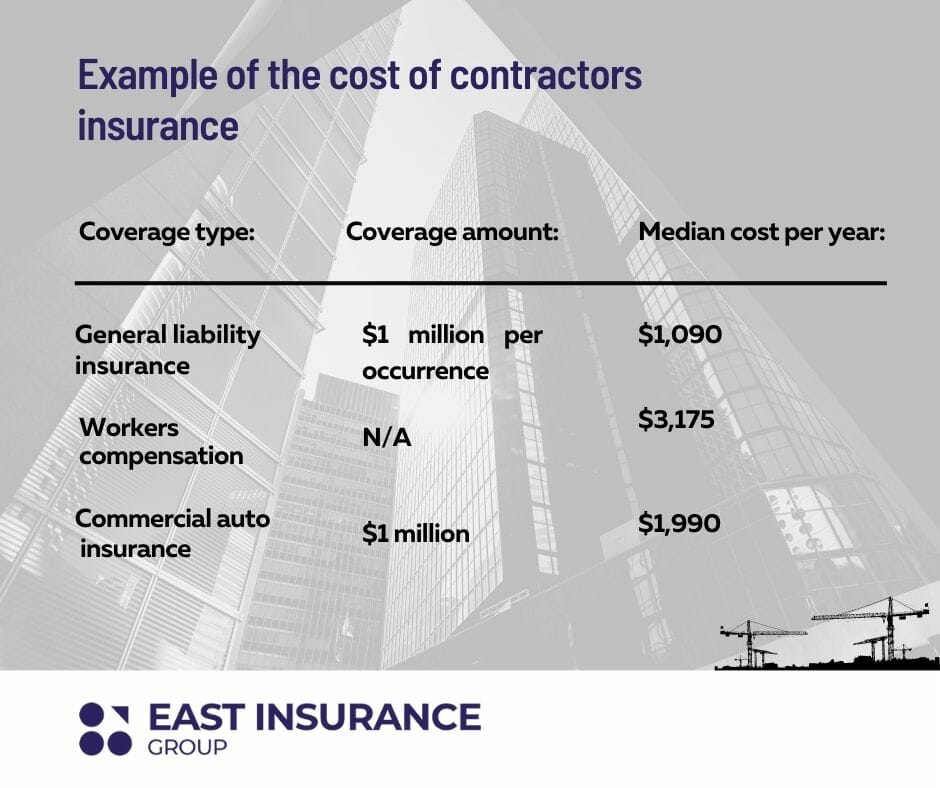

How Much Does Contractors Insurance Cost?

Usually, the cost of contractor business insurance is around $90 per month. Several factors impact the contractor’s business insurance cost, including:

- Number of employees

- Your specific business needs

- Claims history

- The type of work

- Location

- Number of vehicles

- Policy limits

Contractors Insurance Examples

How to Lower the Cost of Contractor Insurance

You decide the level of limits on your policy. So if your business is considered to be low risk, you may feel comfortable choosing a lower liability limit. That means the price of your insurance policy would also be lower.

One of the ways contractors can save money is by bundling general liability insurance with commercial property insurance. However, one of the best and most secure ways to find out more about the contractor insurance quotes that fit your business needs is to talk to an insurance specialist directly.

Luckily, the price of contractors insurance is usually worth the value. To provide the scope, the average cost of someone slipping and falling on-site can amount to $20,000. If you consider that a simple rate of $35 per month could make a big difference for your business in case of an accident, then having contractors insurance makes financial sense.

Other ways to lower the cost of contracting insurance are:

- Bundle a few policies

- Show around and compare insurance quotes

- Implement safety programs

- Pay your premiums in full

- Increase your deductibles

How Contractor Insurance Works

General liability insurance for contractors is designed to par repairs of the work that is in progress in case it gets damaged by an insured risk like fire, flood, storm, or theft. The more policies you combine, the more risks it covers. However, it doesn’t mean you should buy all the policies that are offered.

At East Insurance Group, our experienced agents can craft an offer according to your specific needs. That’s why you can contact us anytime, and you will get an offer or information about the policy you need in no time.

Are Contractors Required to Have Insurance?

No, contractors are not required by the law to have contractor’s insurance. However, if you don’t have insurance, you could be held personally liable for a work-related mistake. Also, your clients may require you to show proof of insurance before taking the job.

Who Needs Contractors Insurance?

It’s recommended that contractors and subcontractors carry commercial insurance as it covers their businesses. Here are some industries that need contractor insurance:

- Carpenters

- Plumbers

- Painters

- Electricians

- Handymen

- Masons

What’s The Difference Between a Certificate Holder and an Additional Insured?

A certificate holder is a contractor or a business that carries the coverage as it says on the certificate of insurance. An additional insured is the other contractor or a business that is also listed on the holder’s insurance policy.

Do I Need Workers’ Compensation Insurance If I’m an Independent or Self-Employed Contractor?

Usually, independent and self-employed contractors don’t have to carry workers’ compensation insurance. It can, however, be required in some cases to fulfill a contract.

Are you still confused about contractor insurance, or do you need some help getting a quote for your business? Contact us today and get all the information you need fast and for free!