Condo Insurance: Everything You Need to Know

If you live in a condominium, you might count on either condo or homeowners association (HOA) to take care of the building and common areas. However, this won’t help you if someone steals or destroys your personal belongings. In these cases, you can count on condo insurance, also known as HO-6 insurance. Here’s the ultimate condominium insurance coverage guide that will help you get all the necessary information you need before you make a purchase.

If you live in a condominium, you might count on either condo or homeowners association (HOA) to take care of the building and common areas. However, this won’t help you if someone steals or destroys your personal belongings. In these cases, you can count on condo insurance, also known as HO-6 insurance. Here’s the ultimate condominium insurance coverage guide that will help you get all the necessary information you need before you make a purchase.

What is Condo Insurance?

Generally speaking, condo insurance covers everything your homeowner’s association doesn’t, including repairing the inside of your apartment after disasters or replacing stolen and damaged belongings.

Another name for condo insurance is HO-6 insurance. This term refers to one of several home insurance policy forms that are used in the industry. That said, most homeowners use HO-3 policies for their insurance, while those who rent have HO-4 policy forms.

HO-6 condo insurance policy form is used to insure co-ops and condos. This might come as a surprise because the ownership structures of condominiums and co-ops work differently, however, insurance policies for individual owners work in a very similar way.

Besides HO-6 insurance, condo insurance is also frequently referred to as “walls in” or “paint-in” coverage. The reason for this is because condo insurance is the policy that covers the interior of your unit from the walls in, including all your personal property.

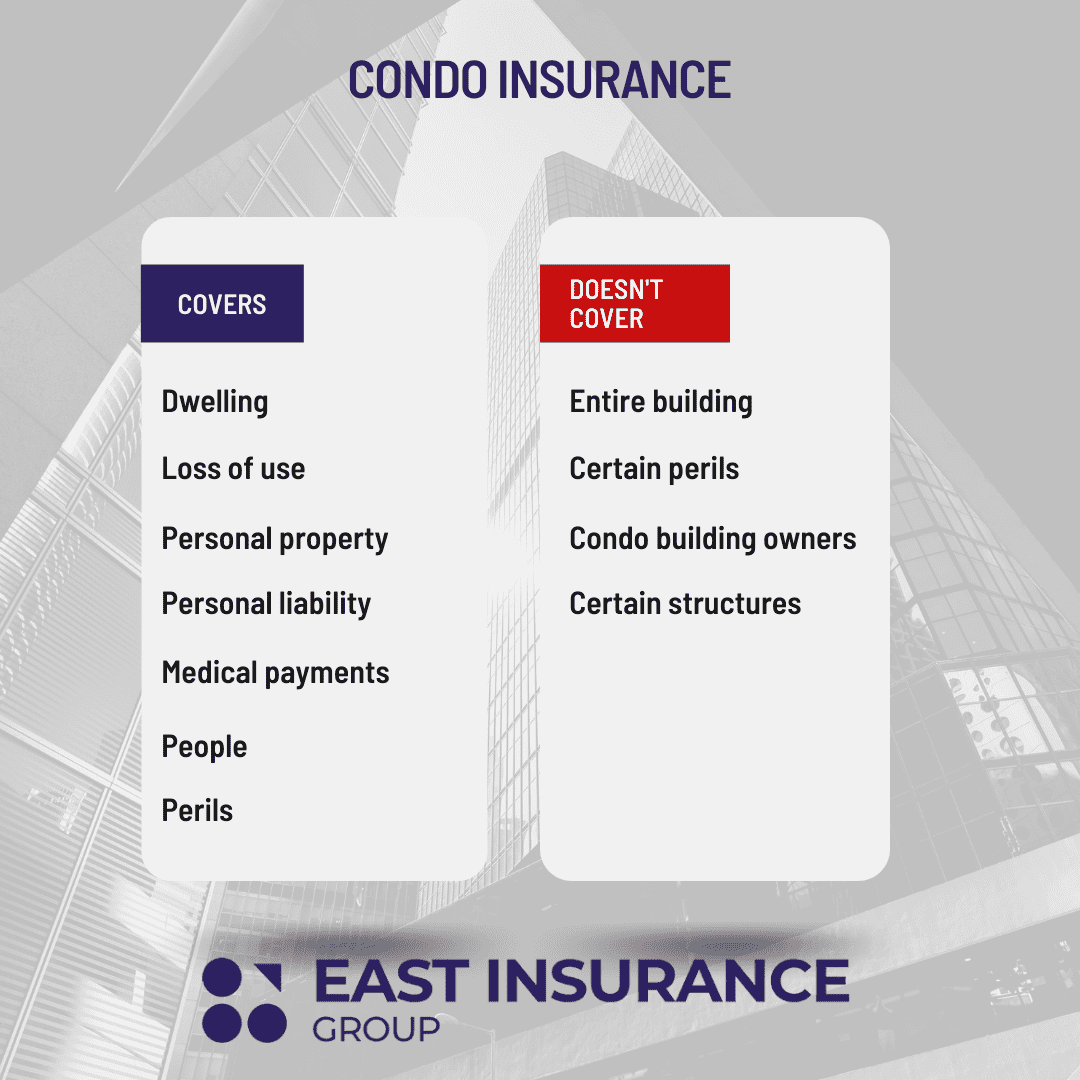

What Does Condo Insurance Cover?

Usually, some of the condo fees are covered by a master insurance policy that covers certain disasters and liability issues. A standard HO-6 policy includes:

Dwelling Coverage

Dwelling coverage protects your condo from the walls. This type of condo insurance policy pays for damaged walls, ceilings, floors, additions, and other types of issues.

Personal Property Coverage

Personal property coverage protects the belongings that make your unit a home including cabinets, furniture, appliances, clothing, decor, and more.

Loss of Use Coverage

This type of coverage is particularly useful in case a covered claim makes your home inhabitable. Loss of use coverage is the type of policy that can help pay for additional living expenses, such as a hotel stay, for example.

Personal Liability Coverage

Personal liability coverage can help pay for legal fees in case someone gets hurt in your condo or you accidentally cause damage to someone else’s property.

Medical Payments Coverage

Medical payments coverage is a type of condo insurance policy that helps cover small medical expenses when a guest gets injured at your home.

Perils Coverage

This type of HO-6 insurance policy covers damage from incidents such as wind, fire theft, smoke damage, frozen pipes, and vandalism.

What Doesn’t Condo Insurance Cover?

There are certain types of damage that are usually excluded from the policy, including:

- Earthquake

- Water damage from flood

- Demolition of home required by law

What Does Homeowner’s Association Cover?

Before you choose the right condo insurance coverage for your unit, you should understand what your homeowner association’s master policy covers. There are three common types of master policies that a condo association chooses from:

- All-Inclusive Condo Insurance: All-inclusive or all-in condo insurance coverage helps cover all individual condos’ exterior and interior, including installations, additions, and fixtures. In this case, the individual owner is responsible for personal property.

- Special Entity Condo Insurance: Special entity covers almost all of the condo structure except structural improvements and unit additions. In this case, the unit owner must have a personal property coverage policy.

- Bare Walls in Condo Coverage: Bare walls coverage is focused on insuring your unit’s interior contents, including countertops, fixtures, and your personal property.

How Much Dwelling Coverage Do I Need?

The amount of coverage you may need for your condo depends on whether the homeowners association policy is for bare walls or wall studs in. If it is, you might need more HO-6 insurance.

A rule of thumb for deciding how much condo insurance coverage you need to protect your belongings and the interior of your unit is to assume $40,000 in personal property for the first 1,000 square feet of your condo. Then add $5,000 for each additional 500 square feet. On the other hand, the best way to know how much property you have and need to cover is to take an inventory of your belongings.

Usually, liability coverage for condo insurance starts at $100,000. One of the best ways to decide how much coverage you need is to calculate the total amount you are able to lose in case someone sues you, including your savings, investments, vehicles, and other assets. Then you should select enough liability coverage to pay for that amount at least.

Additionally, loss assessment is included in some HO-6 policies, while it’s an optional add-on for others. But even when it’s included, the coverage limit is often very low. That said, you may want to add more coverage to the policy.

Talking to a licensed insurance specialist can help you determine how much coverage you need and can help you understand your condo association’s master policy to find out what’s covered by the homeowners association.

How Much is Condo Insurance?

According to a report from the National Association of Insurance Commissioners, the average condo insurance cost is $506 per year. Condo insurance quotes can vary depending on your location, the amount of coverage you need, and the deductible you choose. For example, condo insurance in NJ may cost approximately $438 per year.

How to Get Cheap Condo Insurance?

There are several ways to reduce the price of your condo insurance:

- Shop Around: Insurance companies usually advise that you get HO-6 insurance quotes from at least three companies before you decide to make a purchase.

- Find Discounts: If you bundle your condo and auto insurance at the same insurance company, you might be able to save money on your policy.

- Raise Your Deductible: This is a good idea only if you are sure that you will have enough savings to pay the higher amount in case of an emergency.

Because buying a condominium includes the shared nature of your living space, you also get to share a part of insurance coverage with the homeowners association. While condo association insurance usually covers building exteriors and common areas, condo insurance covers the interior of the unit and personal property inside.

Did you find this article useful? If you did, make sure you also check our article about commercial property insurance.

Also, ask your insurance professional about the following additional condo coverages:

Let the Commercial Property Insurance Agency, help you understand and protect all of the risks you run and all of the perils your business faces. We will do this with a well thought out and executed business insurance policy designed just for our Condo Insurance policyholders.