Contractor Insurance in New Jersey: Everything You Need to Know

While contractors in New Jersey aren’t legally required to have contractor liability insurance, having this policy makes it easier to run a contracting business. Also known as commercial general liability insurance, contractor liability insurance covers your business from various risks, including injuries, property damages, and legal claims.

Here’s everything you need to know about contractor insurance in New Jersey.

Why Do I Need Contractor Liability Insurance?

There are several reasons why having contractor insurance in New Jersey would be a good idea, including:

- Protect Your Business Assets: The policy covers your tools, vehicles, and properties.

- Run Your Business Stress-Free: General contractor insurance in NJ gives you peace of mind to run your business without being anxious about risks and accidents.

- Win Potential Clients: Nowadays, everyone checks potential hires on the internet. Having insurance makes you more trustworthy in the eyes of potential clients.

Types of Contractor Insurance in New Jersey

Coverage for Third-Party (General Liability)

If someone visits the construction site, they don’t have to worry because they are also protected with the general liability of the New Jersey contractors policy insurance.

It is essential because whenever they get hurt caused by falling debris or lumber, the medical fees will be paid by insurance. On the other hand, if the personal belongings of the owner like their car are being damaged at the site, the repairs for the property damage will be paid by the general liability insurance.

Tools & Equipment Coverage

If you are bothered about losing access to your valuable equipment or tools, you can be assured that New Jersey contractors liability insurance is a big help. This coverage is meant to pay or replace any piece of equipment being used in the construction business. Buying a new wrench after being stolen or lost might be feasible, but getting a new excavator is not.

Employee Coverage

Workers’ compensation coverage is available to pay for the treatment of an employee who gets injured in any way possible while performing their work. Also, workers’ compensation insurance in NJ might be of big help whenever an injured employee plans a lawsuit against one’s business. The coverage can also be connected to bodily injury, which ensures the employee’s safety and security. Bodily injury coverage will pay for any damage done to workers while doing their job.

Business Vehicle Insurance

If you plan to operate or use your company‘s car, a commercial automobile, or even your own car for work reasons, you must consider vehicle or commercial auto insurance from the NJ contractors insurance. Should you ever cause an accident to someone while driving the car for business purposes, the damages you caused will be paid for by the auto insurance.

Surety Bond

A surety bond ensures that you abide by rules and regulations that govern your industry and it protects you from poor performance or dishonest behavior. Having a surety bond means a lot to your customers as it sends them a message that you are safe to do business with.

How Much is General Contractor Insurance in NJ?

General contractors pay a median premium of about $1,090 per year for general liability insurance.

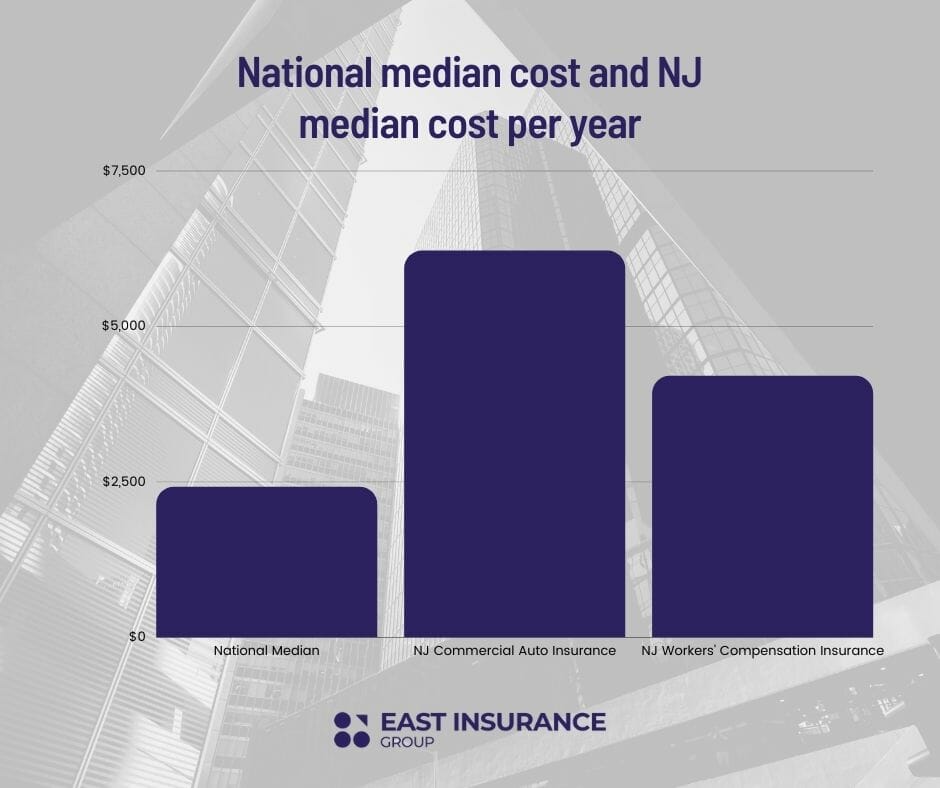

The median annual cost of commercial vehicle insurance for contractors in New Jersey is $6,213. This is significantly more than the national median price of $2,417.

Furthermore, contractors in New Jersey will pay a bit more on average for workers’ compensation insurance and umbrella insurance. Here’s a chart that shows the difference between the national median cost and the NJ median cost per year:

How Do I Get My Insurance License in NJ?

The first step towards obtaining a New Jersey contractor license is registering with the New Jersey Division of Consumer Affairs. The fee to submit an application is $110. The application must be printed and sent with a valid check and all required materials for the contractor. NJ license requirements for general contractors include:

- A business name

- The business trade name or Certificate of Formation

- The business’s phone number

- Federal employer identification number (EIN)

- Valid contact information

- Social Security number

- Proof of liability insurance of $500,000 or more per occurrence

- Signed disclosures about each business partner or owner’s criminal history

Working without a general contractor license in New Jersey could get you a fine of $10,000.

Does a Commercial Contractor Need a License in NJ?

Contractors who work exclusively on commercial properties aren’t required to have a commercial contractor license from the state, but they may need to obtain the policy from the city or county where they work.

Do I Need Indemnity Insurance as a Contractor?

While general liability insurance may cover construction workers in case of an accident or injuries, you will need indemnity insurance if they don’t meet deadlines or if the work they provide isn’t up to the standards of the client.

Read also: Builders Risk Insurance NJ

Confused about contractor insurance in New Jersey, or need some help getting a quote for your business? Call us or fill out a quote request form and get all the information you need fast and for free!

Get A Quote And Get Coverage Today

Our Insurance Specialists are ready to help you out.

New Jersey Insurance

- EIG Adminhttps://eastinsurancegroup.com/author/admin-2/

- EIG Adminhttps://eastinsurancegroup.com/author/admin-2/

- EIG Adminhttps://eastinsurancegroup.com/author/admin-2/

- EIG Adminhttps://eastinsurancegroup.com/author/admin-2/