Commercial Flood Insurance: Everything You Need to Know

If you own a business in a high-risk flood area, you might want to consider having commercial flood insurance. The reason for this is that most insurance policies don’t cover losses that result from floods. Also, flooding can happen everywhere, not just in coastal areas.

About 90% of all US natural disasters involve flooding, according to the Federal Emergency Management Agency (FEMA). One inch of floodwater can cause up to $25,000 in damages to a home.

When it comes to commercial property, to avoid paying the high cost of damages from floods, especially if you invested a lot of money in your business, you should consider protecting your assets and your business with commercial flood insurance. Here’s what you need to know.

What Does Commercial Flood Insurance Cover?

Private commercial flood insurance covers businesses against damages that result from floods. Usually, floods are caused by heavy rainfalls, storm surges, ruptured dams, and overflowing streams.

It’s important to note that commercial flood insurance policies are issued by the National Flood Insurance Program (NFIP), and they usually include building and contents coverage. Flood insurance for commercial property protects the business structure of your business, including floors, plumbing, and walls. On the other hand, contents coverage protects furniture, curtains, precious metals, portable air conditioners, etc. For business owners, the limit for both types of coverage is $500,000. Also, each coverage has its own deductible.

What Doesn’t Commercial Flood Insurance Cover?

There are some exclusions to standard commercial flood insurance policies, such as:

- Damages caused by sump pump backups

- Damages that come from mold or mildew that you could have avoided as a business owner

- Financial losses that come from business interruption

- Commercial vehicles

- Valuable documents

Do I Need Commercial Flood Insurance?

As mentioned above, flooding is the most common natural disaster in the US. Some floods are caused by hurricanes and tropical storms, while others occur as a result of thunderstorms, heavy rains, or rapid snowmelt. Regardless of how they occur, floods cause major damages to homes and businesses across the US.

If you are still wondering whether you need commercial flood insurance as a business owner, ask yourself if you meet the following criteria. If you do, there’s a chance you might want to consider purchasing commercial flood insurance:

- Your area is located in an area defined as a high-flood risk

- You have a mortgage from a federally-regulated or insured lender

Is Commercial Flood Insurance Required?

Businesses in the US aren’t required to buy flood insurance. However, it is recommended to acquire this type of insurance if you are located in a moderate-to-high-risk flood zone. Only companies that have a mortgage with a federally insured or regulated lender are required to purchase commercial flood insurance.

While business owners in other locations might not be required to have this policy, this type of insurance can be beneficial if:

- You conduct business in a region with warm springs and snowy winters

- You witness moderate rainfall in the springtime

- Your business basement floods and leads to damaged inventory and equipment

How Much Does Commercial Flood Insurance Cost

Many insurance companies offer preferred risk policies for businesses in low-risk areas with coverage for both the commercial property and contents for one low premium. Another option is a contents-only policy that costs substantially less.

For businesses in high-risk areas, the premiums are higher with separate building and contents coverage. Separate deductibles apply to the commercial property and the contents with different amounts possible for each. Business owners can pay the premium annually in one lump sum.

To lower the premium on your commercial flood insurance, you can request a higher deductible. However, you should keep in mind that this will reduce the payment of the total claim if there is a loss. Typically, claims are paid for the actual cash value of the building and its contents.

Commercial flood insurance quotes are based on multiple factors, including:

- The age of your business property

- The building’s occupancy

- The number of floors in the building

- The location of the contents

- Flood risk level

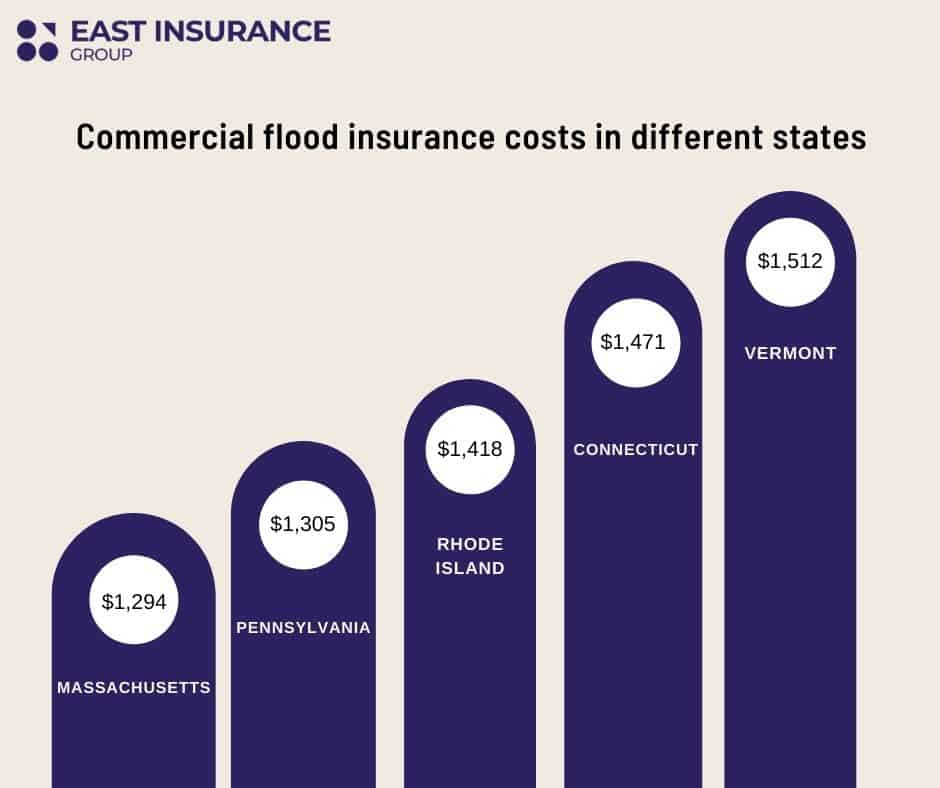

On average, annual commercial flood insurance premiums range from $500 to thousands of dollars, according to CoverWallet. To choose the best policy that suits your specific needs, you should evaluate them carefully before making the purchase. If the coverage you need exceeds the NFIP’s limits, you may need additional coverage via a private insurance company.

East Insurance Company can help you cover all your business needs in case you require commercial flood insurance. To get the best offer according to those needs, feel free to contact one of our experienced insurance specialists and get your quote today, for free!