Landlord Insurance Coverage in New Jersey 101

If you only plan to have tenants on your property occasionally, the best option is to stick with the standard property insurance, specifically homeowners’ insurance. It offers coverage if you live in the house while renting a room to tenants. However, if you plan to rent out the entire home, the best way is to purchase landlord insurance. But both homeowners’ insurance and the landlord policy can save you hundreds of dollars annually and offer the best protection from the risks associated with your rental property, including buildings and contents insurance.

If you plan on having tenants reside at your entire property, we have listed everything you need to know about landlord insurance policies, from the coverage, costs, and where to get the best deals.

Here’s everything you need to know about landlord insurance in New Jersey.

What Does New Jersey Landlord Insurance Cover?

Landlord insurance is different from property insurance as landlord policies do not cover the building’s content.

The homeowner will not need property insurance if homeowners rent out their properties, whether it’s a small townhouse or a large apartment complex, because they do not need to cover the building’s content, which becomes the responsibility of the tenants.

A basic landlord property policy will cover the following:

The Structure of the Main Building

Homeowners renting their properties have the building’s structure covered with the policy if they get damaged by perils like storms, vandalism, or fires.

However, unlike property insurance, the building’s contents are not covered except for internal systems, such as built-in appliances, plumbing, electrical wiring, and HVAC (Heating, Ventilation, Air Conditioning).

Other Buildings

A landlord insurance policy covers detached rental properties, like tool sheds, garages, laundry buildings, workout facilities, and eateries.

Landlord Liability Insurance

The landlord liability coverage is one of the essential coverage items for any insurance for rental property. It protects you when a tenant or guest gets injured in the renters’ house or anywhere on your rental properties and chooses to file a lawsuit or claim against your rental business.

Most legal claim cases involve a tenant getting injured when slipping and falling on the property, caused by a faulty staircase or a walkway not cleared of debris.

The maintenance of the rental property is the responsibility of the landlord, making you liable for damages. These expensive lawsuits can give you a run for your money, so having adequate insurance coverage is essential. It will ensure that any injuries to the renter or the property will be covered.

Landscaping

This policy provides coverage for repairs or replacement when your lawn or garden gets damaged by natural calamities such as hurricanes, blizzards, and floods.

The coverages mentioned above are part of the standard landlord insurance policy. However, depending on your financial situation, you may want extra protection beyond the basics to protect your rental property.

New jersey landlords can include the following coverage options in your insurance policies:

- Loss of Rental Income – This will cover the expenses when you lose income when your rental properties become uninhabitable due to perils like hurricanes, fires, or damage caused by a tenant.

- Workers Compensation – If you have any workers working at your rental property, the New Jersey law requires you to include this coverage in your policy.

- Umbrella Liability – This provides broader liability coverage with higher limits, which can help you from lawsuits when tenants get injured at your rental property.

- Flood Insurance – This coverage protects your rental properties against flood damage, which is essential in New Jersey as it is prone to blizzards and hurricanes.

How Much is Landlord Insurance in NJ?

Nationwide, the average price of landlord insurance is somewhere around $1,300 a year.

The prices of insuring your rental property in NJ depend on several factors, such as the size of the unit. When you own small units like condos or townhouses, the landlord insurance rate is minimal because homeowners usually split these expenses with the homeowner association. You can also check condo insurance in NJ.

However, if you own a single-family home or a large rental property, the landlord insurance rates will be higher because the building’s replacement cost will solely be the homeowner’s responsibility.

The following are the factors that influence the premium costs of landlord insurance policies in New Jersey:

ZIP Code

Your units’ location affects your insurance rate as homes near coastlines, beaches, and other cities prone to flooding experience more property damages. Areas in a particular ZIP code in NJ that’s near bodies of water have higher rates.

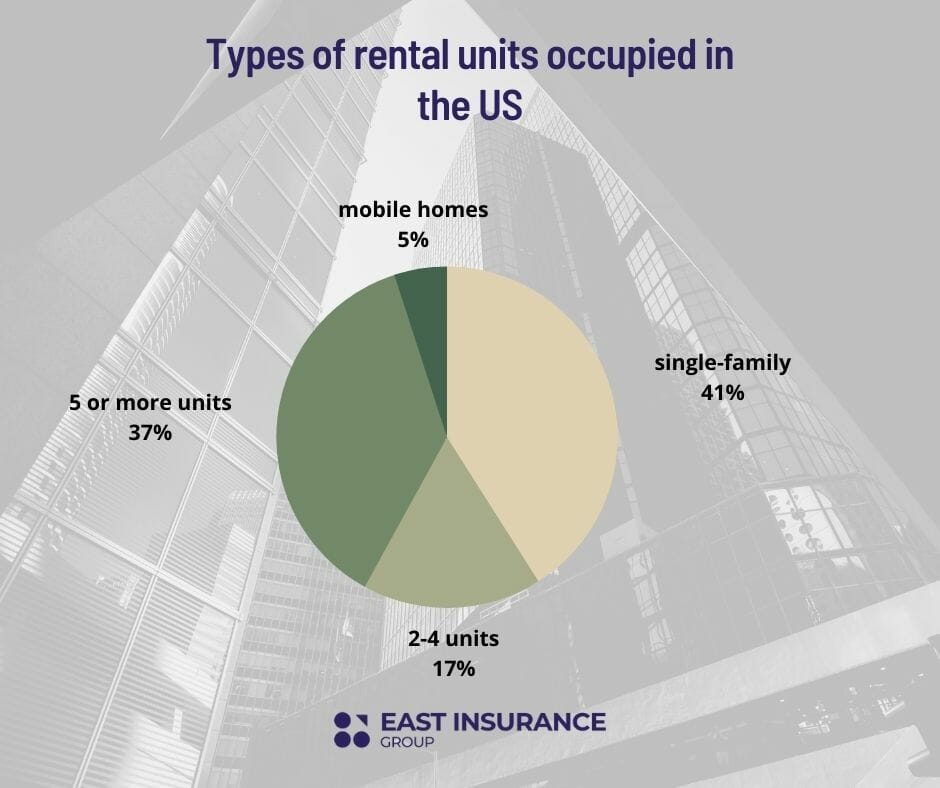

Building Type

More prominent buildings like single-family homes and apartment complexes typically have higher insurance rates than small units like condos, townhouses, or bungalows.

Claim History

If you have gotten one or more claims in the past three years as a landlord, most insurance carriers will surcharge your insurance price.

If you want to save costs, you can compare different price quotes from renowned insurance companies to grab the best deals. You can also ask about discounts or request higher deductibles to bring your insurance rate to an all-time low.

Who Needs the Landlord Insurance in New Jersey?

If you rent your property, you will probably need landlord insurance because homeowners insurance doesn’t cover properties that are not occupied by its owners. This type of coverage is beneficial as it covers property damage and lost renal incomes.

What Doesn’t Landlord Insurance Cover in New Jersey?

Landlord insurance in NJ doesn’t cover tenants’ belongings, such as furniture, computers, electronics, and clothes. To cover their belongings, your tenants need to purchase their own renter’s insurance policy.

Where Can I Buy New Jersey Landlord Insurance?

Many landlords in the Garden State are unaware that their homeowners’ policy will not be enough to cover damages caused by their tenants. Call East Insurance Group today to help you choose the best coverage options for your policy to protect your rental business to the fullest.

Confused about landlord insurance in New Jersey, or need some help getting a quote for your business? Call us or fill out a quote request form and get all the information you need fast and for free!

Get A Quote And Get Coverage Today

Our Insurance Specialists are ready to help you out.