Everything You Need to Know About Commercial Truck Insurance in Maryland

Most Maryland truckers have had to cut costs and find opportunities to save money in every aspect of their business.

But can you lower the costs of your commercial truck insurance? What are the benefits? And requirements?

Read on to learn about commercial truck insurance in Maryland.

What Is Commercial Truck Insurance in Maryland?

Truck insurance in Maryland is a comprehensive policy that covers your liability risks in case you or your drivers get involved in an accident. Commercial truck insurance in Maryland usually covers medical expenses, injuries, and property damages during an accident. The policy can also include theft or damaged products the truck is hauling.

Who Needs Commercial Truck Insurance Maryland?

Anyone who drives trucks for business purposes in Maryland should consider having commercial truck insurance. This insurance is especially helpful for small businesses that offer trucking services and organizations that use trucks to haul goods and products.

Types of Commercial Truck Insurance in Maryland

Some types of Maryland truck insurance are mandatory, such as primary liability.

On the other hand, coverages like physical damage or bobtail insurance are recommended to truck owners as a good way to protect their assets.

- Primary Liability Coverage: This type of insurance is mandatory for all commercial trucks. The policy covers bodily injuries and property damages. Truck drivers who don’t have this insurance risk large fines and penalties.

- General Liability Coverage: Whether you are on or off the road and regardless of the size of your business, this type of policy is always a good idea as it covers risks to your business outside of using your truck for business purposes.

- Physical Damage Coverage: This type of policy covers your truck in case it gets damaged, including vandalism, fire, and theft.

- Bobtail Coverage: This type of coverage pays for property damage or injuries to others that you caused while the truck trailer was detached from it.

- Medical Payments Coverage: The policy offers payments for injuries to you, your employees, or anyone riding the truck with your approval.

- Uninsured Motorist Coverage: Uninsured motorist coverage is mandatory in Maryland. It covers payments for damages to your truck caused by another vehicle that doesn’t have enough or any insurance.

- Workers’ Comp Coverage: This type of policy covers your truck drivers in case they get injured while driving the truck for you.

What Does Commercial Truck Insurance in Maryland Not Cover?

Maryland commercial truck insurance is quite comprehensive, but there are still some things that it doesn’t cover, such as:

- Specific vehicles that aren’t trucks (for example, limos, buses, and passenger vans)

- Driver injuries

- Lost product due to broken refrigeration

- Loss of cargo

- Loss of income after an accident

Read More: The Complete Guide To Commercial Truck Insurance

Maryland Truck Insurance Requirements

Maryland state law requires local truckers and new ventures to have a certain amount of liability insurance, such as semi-truck insurance. The amount you need is determined by the type of freight you carry and where you carry it. Suppose you never leave the state and your truck is more than 10,000 GVW. In that case, you must get an intrastate-only USDOT Number and maintain a minimum level of insurance:

| $5,000,000 | Liability Insurance (Hazmat) |

| $300,000 | Liability Insurance (Household Goods) |

| $750,000 | Liability Insurance (General Freight) |

| $1,000,000 | Liability Insurance (Oil Transport) |

Maryland commercial truck insurance requirements for Maryland truck drivers who cross state lines are a little more complicated. In addition to the above, you must meet all the DOT truck insurance requirements recommended by the federal government.

Most federal liability limits are $750,000 or $1,000,000.

Maryland Truck Insurance Filings

Both Maryland and the USDOT require certain filings to be submitted by your insurance specialist. The insurance specialist or company will fill out and submit these filings for you. These forms tell the government that all your semi-truck insurance requirements are fulfilled. They must be filed before you can get your authority. Some common forms include:

- Form MCS-90

- ICC

- Form H

How Much Does Truck Insurance Cost In Maryland?

As a general rule, the average cost for commercial truck insurance in Maryland is about $17,500.

Maryland truck insurance quotes are based on several factors, such as:

- The type of cargo you are hauling

- Your driving history

- Years of experience

As a combination of specific auto insurance policies created to meet the needs of your trucking business, commercial trucks in insurance in Maryland can help you cover your most valuable business assets in the case of an accident.

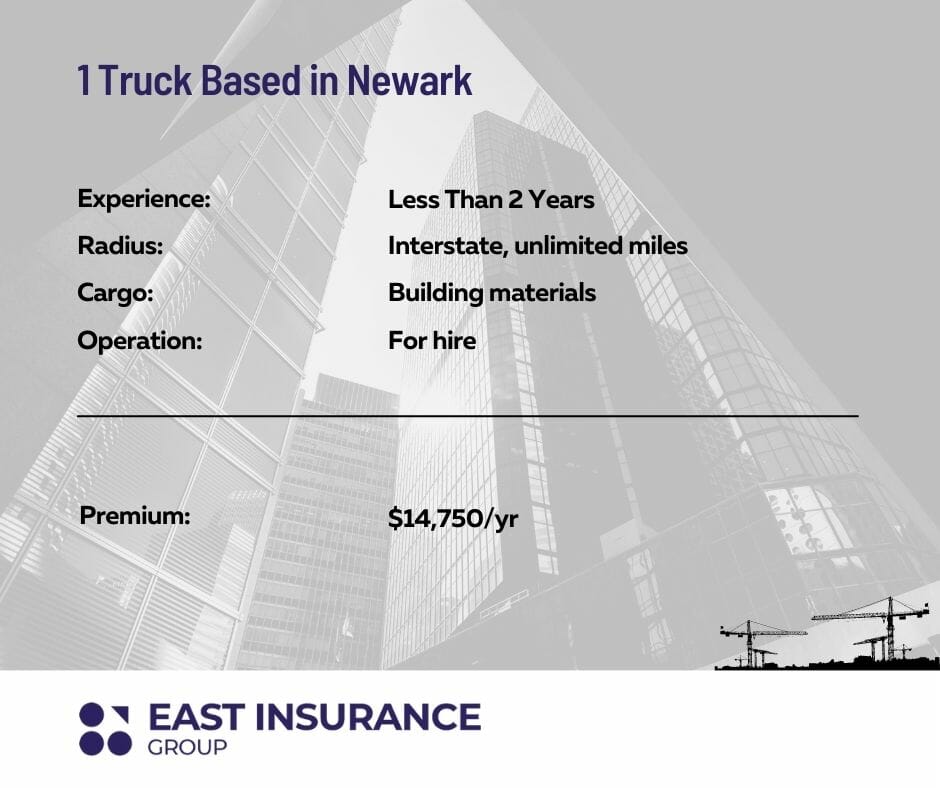

A Real Example Of Truck Insurance Costs In MD

How to Lower the Costs of Commercial Truck Insurance in Maryland?

Commercial truck insurance in cities like Baltimore, MD is not cheap, and it’s not something you should think about cutting out of your budget. Fortunately, there are ways to lower the costs of your insurance premium, including:

- Hire experienced drivers

- Hire drivers with clean records

- Verify drivers’ history

- Use new trucks

- Consider higher deductibles

East Insurance Group as been saving truckers money on Maryland truck insurance for years now. We also save customers money on trucking insurance in Maryland cities like:

|

|

Are you still confused about commercial truck insurance in Maryland or do you need some help with getting a quote for your business? Contact us today and get all the information you need fast and for free!