If you are an owner-operator truck driver, claim all your tax deductions for truck drivers’ load expenses when it’s taxation time. Like virtually all taxpayers, you can significantly lower your tax liability and taxable income by availing of deductions and handling your tax situation properly. You can also benefit from your meal allowances and claim tax write-offs for truckers on your tractors and other equipment.

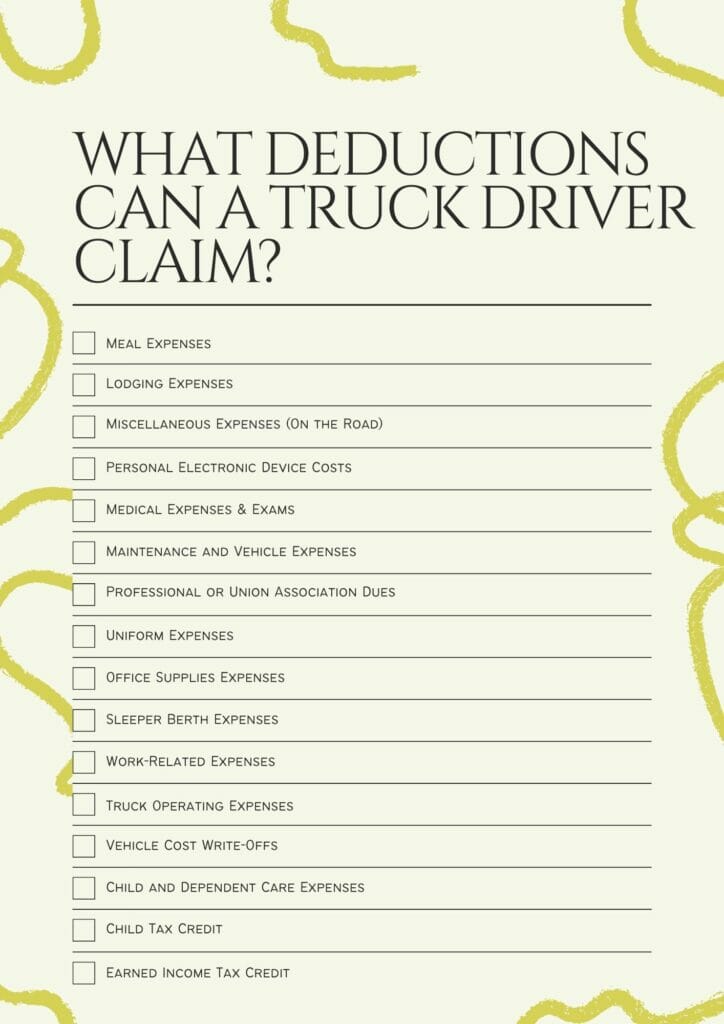

So what deductions can help you save money? Here are 16 truck driver tax deductions:

- Meal expenses

- Lodging expenses

- Miscellaneous expenses

- Personal electronic device costs

- Medical expenses

- Maintenance and vehicle expenses

- Professional or union association dues

- Uniform expenses

- Office supplies expenses

- Sleeper berth expenses

- Work-related expenses

- Truck operating expenses

- Vehicle cost write-offs

- Child and dependent care expenses

- Child tax credit

- Earned income truck driver tax credit

You may have other reporting requirements besides your tax returns and must pay permit costs and additional taxes. By claiming your per diem rate and other truck driver tax deductions, you can reduce the tax you pay. And, as an owner-operator truck driver, you should know everything about trucker tax deductions.

Truck Driver Taxes: Forms You Need to File Taxes

- A W2 form is received by company drivers that provide a report of the wages and income of the driver.

- These forms must be mailed to the employees by the employers by the end of January.

- This income must be reported on Form 1040 or 1040A.

- As an owner-operator, you have different income reporting options and can depend on your records.

- If you are working as an independent contractor for the company, you will get a Form 1099, which is utilized to report any miscellaneous income.

- In case you are a commission driver or an agent, your W2 may have the “Statutory Driver” box checked.

- Self-employed and statutory drivers must fill out the Schedule C form. This is used to determine the profit and loss of the business.

Related article: Best Trucking Companies to Work For

What Trucker Tax Deductions Can a Truck Driver Claim?

Download the Truck Driver Tax Deductions Worksheet in PDF to help you save your money on taxes!

Truck drivers can deduct business expenses that are “regular and necessary” by the IRS. While these expenses vary per individual, some expenses are standard.

1) Meal Expenses

You can deduct the cost of your meals that you incur when you are at work, away from home. To increase your tax savings, you must save your meal receipts. Or, you can deduct the standard meal allowance stipulated by the IRS for the transportation industry and use your logbooks as proof.

2) Lodging Expenses

Expenses that are incurred for lodging are deductible. However, there is no standard lodging allowance, so you must keep receipts for each expense. To claim lodging expenses, you need to stay away from home overnight.

Your lodging or any other travel expense (e.g., travel costs) can be disallowed if you don’t have a place of residence or a proper place of business. In this case, you would be considered a transient or itinerant, and your place of work will be considered your home for taxation. However, you cannot claim any meals or lodging deductions as an itinerant, as you would never be considered away from your home.

3) Miscellaneous Expenses (On the Road)

To be deductible, the expense of the items should be ordinary and necessary for the job. These include logbooks, tools, cargo straps, safety gear, CB radios, GPS units, etc. Usually, receipts are needed; however, a receipt is not required if the expenditure is less than $75. You must keep a record of all purchases in a diary.

Keep in mind that any personal products that are used for trucking business purposes are deductible. For example, a cooler stores food and drinks, flashlights, sunglasses, binders, luggage, etc.

4) Personal Electronic Device Costs

Electronic items such as cell phones and laptops are included in these expenses; however, since they can be used for personal purposes also, you can deduct the cost of only 50% of the monthly fees. The entire cost can be deducted if the devices are used for work purposes.

This also includes cell phone and internet fees, which are 50% deductible.

5) Maintenance and Vehicle Expenses

You can deduct the expenses incurred on truck maintenance and purchase of supplies, such as the cost of new tires, oil changes, cleaning supplies, repairs, washer supplies, etc. if you pay out of your pocket. However, you cannot claim a deduction if your employer reimburses these expenses. Parking fees and tolls you must pay while trucking are also deductible.

6) Professional or Union Association Dues

If you pay fees as a member of any trucking industry organization or union, you can deduct 100% of these expenses from your taxable income.

7) Uniform Expenses

If you require wearing a uniform when you’re at work, and your employer does not pay for the uniform, then the expenses incurred to buy uniforms are deductible. This expense also includes protective boots, goggles, or gloves. Any laundry expenses incurred while you are away from your home at work are also deductible.

8) Office Supplies Expenses

Expenses incurred on purchasing office supplies you use for your work (to keep track of your day or route), such as writing supplies, logbooks, clipboards, staplers, route maps, etc., are tax-deductible.

9) Sleeper Berth Expenses

If you use a sleeper berth while you’re away at work, items like your bedding, alarm clock, cab curtains, first aid supplies, and mini-refrigerator are all deductible expenses.

10) Work-Related Expenses

Any expenses that are related to your work are tax-deductible, such as:

- Fees for driver’s license renewal

- Fees for DOT physical exams

- Fees for drug testing

- Cost for sleep apnea study

11) Truck Operating Expenses

Expenses incurred to operate the vehicle, such as fuel, insurance & insurance premiums, licenses, maintenance, and taxes, are all deductible, and depending on the cost, some of the expenses can be depreciated. This also includes leasing costs.

12) Vehicle Cost Write-Offs

According to the tax code, many options allow writing off the cost of the truck.

- You can also immediately expense the vehicle up to $510,000 in the tax year (the tax season) that the asset is put into service.

- You can depreciate the cost of the vehicle in the 1st year by 50%.

- Avail normal depreciation.

- Or a combination of all the above options.

These allow the owner-operators to pick any amount to write off at their convenience. The IRS permits a recovery period of:

- 3-year period for over-the-road tractors.

- 5-year period for heavy-duty trucks (more than 13,000 lbs), trailers, and trailer-mounted containers.

13) Child and Dependent Care Expenses

This enables you to recover expenses from caring for a child or dependent. To qualify for the credit, the child must be under 13 years; however, for disabled spouses or children, the eligibility is regardless of age.

14) Child Tax Credit

You could claim a credit of up to $1,000 for every child under 17 years of age living with you, and more than half of the child’s living expenses must be borne by you.

15) Earned Income Tax Credit

This tax refund credit is based on your trucking business income and provides reduced tax liability of around $6,000 or more. This was developed originally for workers with a low income but has not been extended to middle-class families and individuals.

16) Medical Expenses & Exams

Even out-of-pocket fees for medical exams and other medical expenses are deductible — if the employer requires them. Deductibility applies only if the amount exceeds a particular threshold.

One tip we can share while we’re at it is to fill up your health tax savings account (HSA). Funds that go into such an account are pre-tax, meaning you can use them to ensure your HSA is full and functioning (which might come in handy depending on whether you qualify for government subsidies for monthly insurance premiums—see below), while at the same time lowering your tax burden.

The second tip concerns paying monthly insurance premiums and government subsidies for social security. If you apply for health insurance through the government, you need to estimate annual family income first. You can apply for monthly insurance premium subsidies if it is under a particular threshold.

This comes with a caveat, though. If your actual annual family income turns out to be higher than your estimation, you must pay back the balance.

Related article: How to Become a Broker for Truck Drivers

What Expenses Aren’t Deductible?

- Street Clothing: Only the cost of protective clothing or uniforms is permitted as a deduction.

- Lost Income: Lost income does not require to be reported on the tax return, as it is accounted for. Examples of instances that cause loss of income are:

- Time spent to repair or maintain your equipment.

- Because of a deadhead.

- Suffering through an IRS audit or inquiry triggered by you claiming these deductions.

- Reimbursed Expenses

- Tax Home or Personal Cell Phone

- Commuting Expenses

- Personal Trips

As an owner-operator truck driver, you incur load expenses. You may pay more tax if you don’t claim them. These expense lists are regarded as itemized expense lists, not standard expense lists. If you itemize all expenses, you can claim deductions. You must keep all receipts and organize records of your expenses.

You don’t have to memorize the tax law by heart to benefit from applicable deductions! You could use the services of a tax professional who can help you file your returns and get your money back.

General Tips on Truck Company Driver Tax Deductions

Here are some general tips that would pay to follow to make the best out of standard deductions, pay tax on time, and avoid penalties and audits from the IRS.

Prepare Documents and Your Tax Return on Time

Contractors will need their 1099-NEC form (which they use to report income for their services given) by January 31, the year that follows the tax year reported. You’d want this form sent to the contractors and then to the IRS well ahead, probably by mid-January.

Business owners must send out 1099 forms by January 31st, 2023. Also, make sure that you calculate and pay your quarterly tax estimates. This has several advantages:

- Paying taxes approaching Tax Day will feel a lot less punishing to your account since you already pre-paid most of the liability;

- You must do it, and if you don’t, you might get penalized for underpayment (calculated on how much you owe);

A good rule of thumb would be to set aside about 1/4th of your net income each week for your quarterly estimates. Just cut it out, maybe send it to another account, and make the payment each quarter. Finally, if you think you underpaid the estimation throughout the year, you can catch up with the 4th quarter by paying more (but try to avoid this as it can trigger a penalty or an audit from the IRS).

The best approach is to have an accountant get everything you have in order well before submitting them (see below).

Hire an Accountant

We know that taxes are boring. Filing tax returns and forms is boring. Some people revel in looking at them, working on their tax savings, and extracting something meaningful from them: accountants.

If you find filing taxes cumbersome and bland, our advice would be to employ an accountant or a tax consultant. They will review all the documents you send them and petition you for any additional info they might need. Ultimately, they will produce a filled tax return ready to be submitted to the IRS.

This doesn’t rescind your obligation to keep all the relevant documentation so you can send it to your accountant. Also, accountants and consultants are not machines, and they serve other clients besides yourself. So make sure you submit all required documentation well before Tax Day.

Tax Driver 1099 Tax Advice: What Can a 1099 Truck Driver Write Off?

Here’s a list of some things you can write off on your 1099:

- Mileage

- Car expenses

- Health insurance

- Meals

- Travel expenses

- Interest on loans

Are Trucks 100% Deductible?

Unlike passenger vehicles used for work, trucks are loaded with over 6,000 pounds of gross weight. According to new tax laws for truck drivers in 2023, truck driving companies have two options for a tax deduction for truck drivers:

- Bonus depreciation

- Section 179

Bonus depreciation allows companies to depreciate the full cost of a costly truck in one year, which helps business owners to invest in heavy vehicles for trucking business use. Section 179 is another option set by the IRS. This business asset can be deducted for tax purposes right away instead of being written off over time.

FAQ

Who Can Claim Trucker Tax Deductions?

You can claim trucker tax deductions if you’re a self-employed contract driver. As an employee of a trucking company who receives a W-2 at the end of the year, you can’t claim any of your job-related expenses.

Can Truck Drivers Deduct Meals?

Before 2021, the IRS allowed an 80% deduction. Temporarily for 2021 and 2022, the Federal Consolidated Appropriations Act of 2021 (FCAA) allows a 100% deduction on Per Diem.

Are Deadhead Miles Tax Deductible?

In short, no, you can’t deduct deadhead miles. However, you can deduct all expenses associated with deadhead miles. Also, you can deduct all expenses on all laden miles.

Are Truck Drivers Considered Self-Employed?

Many truck drivers are classified as independent contractors by their employers.

What is the Daily Deduction for Truck Drivers?

After the IRS announced they were keeping the daily rates for truck divers at $69, they changed the per diem rates and allowed drivers to claim an 80% deduction on daily rates from 2023.

Related article: Commercial Truck Insurance

Do you need some help with truck insurance? Call us or fill out a quote request form and get all the information you need fast and for free!