Mike runs a plumbing business in Baltimore MD. He suspected that he was overpaying for his commercial policies, but it wasn’t until a year later when he switched insurers that his suspicions were confirmed. He was misclassified and was overpaying by $5000. It was only after we reviewed his policy that we found the error, fixed it, and saved Mike thousands of dollars in the process.

Mike’s experience is the exact reason why businesses need to review their business insurance policies every year. Errors made, especially by inexperienced insurers can cost businesses thousands and often aren’t caught for years. Not only that, but they also do a poor job of covering the very risks they’re paying to prevent. Even if the agent did a good job they do a good job the first time around, businesses constantly change and need new coverage. Here’s what you need to know about the annual insurance review.

What is an Annual Insurance Review?

An annual insurance review provides a detailed look at your insurance coverage. In other words, an insurance review allows you to check all the policies that are currently protecting your vehicles, home, family members, and other valuables.

Why is it Important to Review Your Insurance?

Many businesses just don’t bother updating their coverage. One web design agency hadn’t updated their coverage for over 10 years, back when the owner was just working with his personal computer out of his basement.

It’s not just the risk of being underinsured. Annual insurance reviews should also help you make sure you’re not overinsured. With an insurance policy review, you can actually see what insurance you need and whether you might be eligible for a discount.

Another great benefit of an annual insurance review is feeling calm about the fact that you will be able to recover financially in case of a disaster. Once you address the insurance gaps and discuss all the potential scenarios with your agent, you will be prepared for the worst.

How Often Should I Review My Insurance?

Generally, it is considered a good idea to review all of your insurance policies at least once a year. However, if you are going through a big life change (you have a new engagement or you recently started a family), you should contact your insurance agent to check how this change may impact your insurance needs.

Types of Insurance Coverage You May Need

It’s common for small businesses to start out with just the basics, such as commercial property and general liability policies. However, as they grow, many other types of coverage get overlooked such as:

- Excess Liability or Umbrella Insurance – This coverage adds extra to the ceiling when the standard coverage isn’t enough.

- Workers’ compensation – This coverage is required in many states and covers medical expenses when a worker gets injured on the job.

- Professional Liability –This coverage protects you from professional errors such as bad advice

- Commercial Auto – This coverage protects your auto fleet or even if your workers travel to clients

- Employment Practices Liability – Coverage for HR issues, such as those related to termination, harassment, and discrimination laws.

- Directors and Officers Liability –Financial protection for directors and officers should they be sued for wrongful acts stemming from the performance of their duties.

- Employee Benefits Liability – Covers liability issues from an omission or error in the administration of an employee’s benefits that results in the employee incurring a cost, such as a terminated employer losing benefits after not being provided with COBRA information.

How to Get the Most Out of Your Insurance

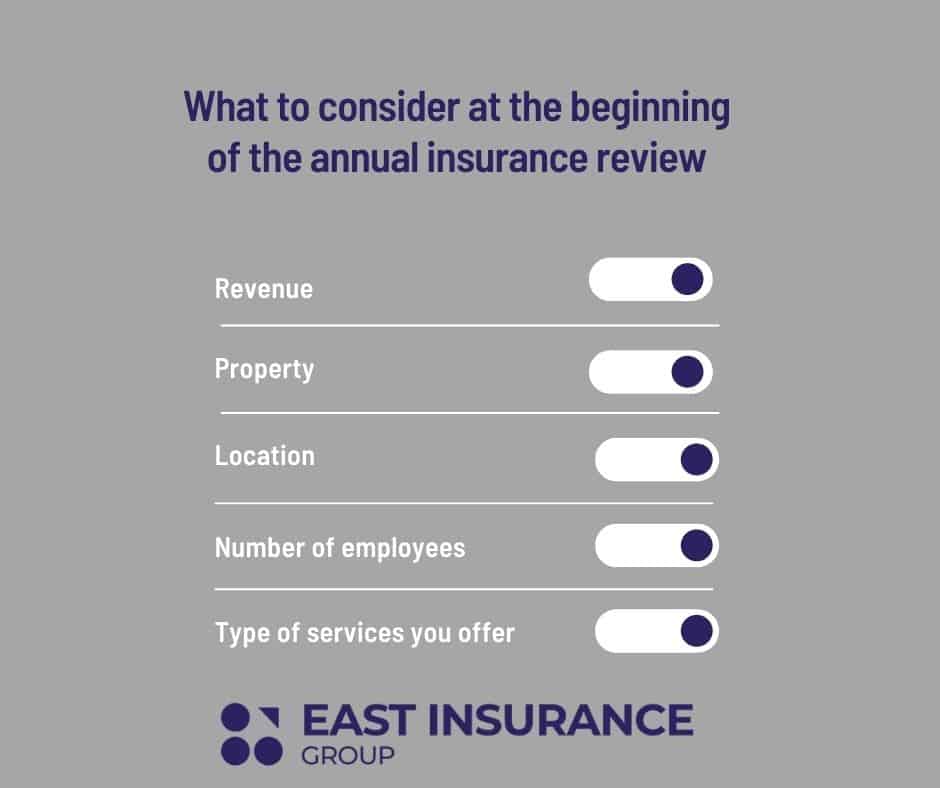

Many of these insurances may be essential to protect yourself adequately, depending on your business. An annual insurance review is an ideal time to discuss these insurances and your need for them with your agent. Ensure the following elements are considered as you begin the review:

The above answers will be different for every business and usually won’t remain the same over the business’s life, and that’s why insurance isn’t a one-size-fits-all, unchangeable product. Take advantage of these attributes and annually review your business for exposures and insurance needs. Insurance may not cover everything, but it can certainly mitigate your risks. Start your annual business insurance review today by setting up a meeting with your insurance agent to discuss the above issues and how they relate to your current insurance needs.

How to Talk With an Insurance Agent

An annual insurance review doesn’t have to take long. If you already know what you want to discuss, you can make sure you are properly covered during a single conversation. Here are some questions you might want to ask your insurance agent:

- Does my policy cover office renovation?

- Does my policy cover outdoor appliances?

- Do I need additional coverage for valuables?

- Can I get a discount?

Confused about the annual insurance review, or need some help getting a quote for your business? Call us or fill out a quote request form and get all the information you need fast and for free!