Hot Shot Insurance: Cost, Coverage, and Benefits

Hot shot insurance is a type of commercial trucking coverage.

Is it right for your business? How much does hot shot insurance cost?

Hot shot insurance costs are between $7,000 to $12,000 annually. The average cost is $10,284 for one truck and trailer.

But there are specific types of coverage, and you can lower your costs. Read on to learn all the details.

If you have questions or want to check the current prices, you can contact us today and get all the information you need fast and free!

What Is Hot Shot Insurance?

Hot shot insurance is meant for truckers specializing in accelerated or expedited cargo transportation. The terms “expediter’s insurance” and “hot shot trucker insurance” are often used in place of each other.

Usually, hot shot truckers transport small loads of cargo and operate short distances. These transporters usually haul items to a customer who does not have plenty of time or does not require a large rig to haul freight.

Also Read: Long Haul Trucking Insurance?

What You Need to Know About Hot Shot Trucking Insurance

Hot shot trucking or “expedited” trucking started long ago when oil production began in Texas and Oklahoma. Hot shot drivers usually brought supplies required for the oil rig and other equipment usually used on the drilling worksite.

Any hold-up getting supplies could cause the entire operation to get delayed. This is why hot shot drivers were stationed on the worksite itself or were on-call so that they could bring whatever was required by the crew very quickly. Then, the operations of the oil rig wouldn’t be interrupted.

Hot shot trucking is different from other types of trucking as this is usually used in emergency situations or when the cargo is required very quickly, mostly within 1 hour of the call out. Usually, hot shot trucking uses regular pick-up trucks to carry the cargo; however, larger trucks may sometimes be used if required.

The hauling of hot shot cargo is quite sought after by truckers; however, hot shot cargo loads may be difficult to come by, and usually, when hot shot loads are involved, the truckers need to drive extra hard to meet the tight schedules. On the other hand, a lot of truckers like to carry hot shot cargo, because they can make more money per mile.

Read More: The Ultimate Guide to Commercial Trucking Insurance

Who Needs Hot Shot Insurance?

Who are hot shot truckers? The answer is pretty easy: hot shot truckers are using their pickup trucks to deliver less-than-loads or LTLs on very tight deadlines and usually to single customers. If you also have a big rig used for traditional trucking and work in state or across state lines, you still belong to the hot shot trucking category.

Here are three types of trucks that are used in hot shot trucking:

- Class 3 (10,001-14,000lbs)

- Class 4 (14,001-19,500lbs)

- Class 5 (16,001-19,500lbs)

Furthermore, the most popular trailers that hotshot truckers use are:

- 20 to 40-foot gooseneck trailers

- Dovetail trailers

- Deckover trailers

- Lowboy trailer

So who needs insurance for hot shot trucking? Suppose you are hauling lighter loads faster, compared to traditional trucking. In that case, you are a hot shot trucker, and you should consider protecting your business with the right insurance – commercial insurance for hot shot trucking.

Why Do You Need Hot Shot Insurance?

Hot shot trucking insurance covers you when your truck and trailer are vandalized, caught on fire, or even stolen. If you are thinking about getting the best insurance for hot shot trucking, here are some numbers that can help you make a decision:

- Around 130,000 people are injured in commercial truck collisions every year.

- 22% of accidents caused by commercial trucks result in injuries to the drivers and passengers in the other vehicles.

- 70% of accidents caused by commercial trucks result in property damage.

- According to the U.S. Department of Transportation, from 2013 to 2014, there was a 13% increase in truck collisions resulting in around 111,000 injuries and around 3,904 deaths.

What Kind of Insurance Is Needed for Hot Shot?

As a hot shot trucker, you will usually need primary liability insurance as the base of your hot shot insurance policy. Generally, you’ll need at least of $750,000 in liability coverage for bodily injuries, property or physical damage, and restoration after an accident.

Hot Shot Insurance Requirements

Because auto accidents are so frequent and their damages are often catastrophic, there are certain insurance requirements for hot shot truckers. For example, in North or South Carolina, only CDL holders with a gross value weight rating (GVWR) of 26,001 pounds or greater are required to hold hot shot insurance.

If GVWR is less than that, you probably don’t need it. It’s also helpful to check with state requirements first before you make a purchase.

Here are other requirements you should meet as a hot shot trucker:

- FMCSA requires a minimum of $750,000 in liability coverage

- Brokers and shippers usually need at least $1,000,000 in liability coverage

- Or you need at least $5,000 in cargo insurance

- If you cross state lines as a hot shot trucker, you will probably need an MC number

- You’re required to have MCS-150 and BOC-3 filings if you are new to hot shot trucking

What Hot Shot Insurance Covers?

Typically, hot shot truck insurance coverage includes:

Liability Insurance

The FMCSA requires hot shot truckers to carry at least around $750,000 in liability. Most shippers and load brokers need at least $100,000 in liability to release your cargo.

Physical Damage Insurance

The physical damage coverage insures your truck in the case of any damage, and the insurance is umbrella insurance that includes:

- Comprehensive Insurance: This protects the truck in the case of fire, theft, and other non-collision damage.

- Collision Insurance: This protects your truck in the case of any collisions on the road.

Cargo Insurance

Cargo limits of $5,000 are needed for federal statues. However, the shippers require $100,000 at least. You will need special endorsements if you haul dangerous materials. And, if the trailer carries multiple loads simultaneously, each BOL requires a $100,000 coverage.

Bobtail Insurance

The bobtail insurance is for Class 7 or 8 trucks, that are not attached to trailers. You need this insurance if you’re a hot shot trucker with a large truck and trailer, wanting more coverage than standard liability. This insurance is not applicable for hot shot truckers driving 1-ton trucks.

How Much Is Insurance for a Hotshot?

Hot shot insurance costs usually vary from $7,000 to $12,000 annually. On average, the price for hot shot trucking insurance is $10,284. This cost is based on 1-truck and trailer, and you will probably need to pay it if you are new in the business. Remember you can reduce this price (we mentioned them below). Several factors impact the cost of hot shot insurance, including:

- The value of your truck and trailer

- Your CDL experience

- The type of cargo you are hauling

- Your deductible and limits

- The coverage type you require

- The insurance company you choose

Before you purchase your hot shot insurance policy and start paying monthly, you will need to pay a down amount. The deposit for hot shot insurance is usually $3000, with monthly payments of around $1,000. Be careful to look at your policy rates before making the final decision, as you could end up paying more.

Read More: The Commercial Insurance Guide

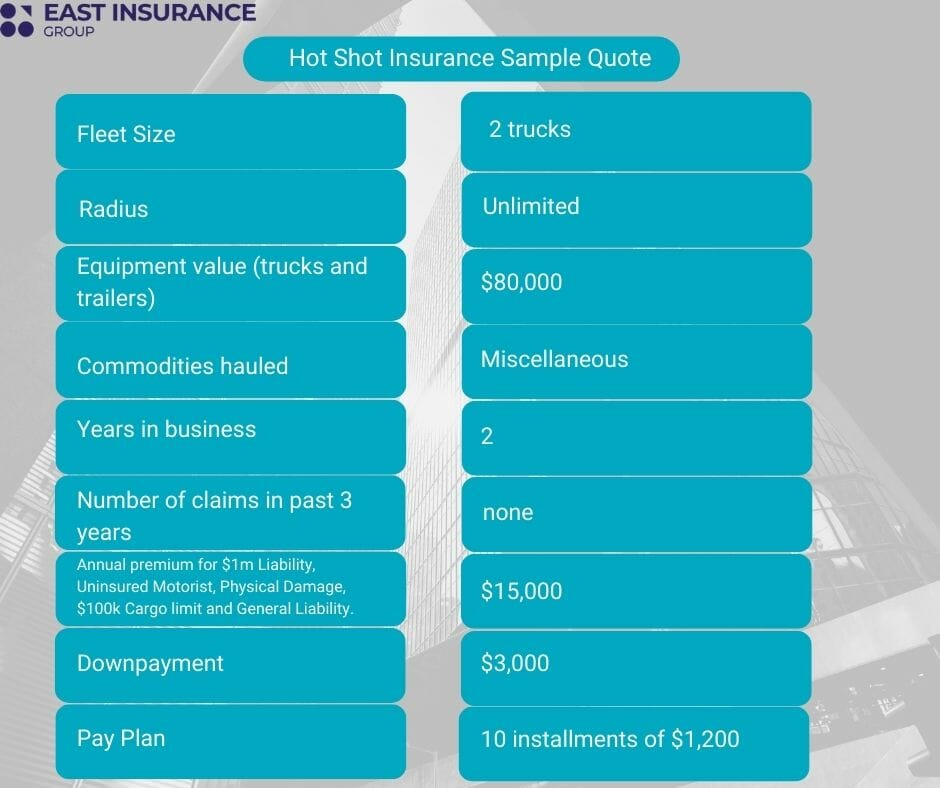

Hot Shot Insurance Sample Quote

One of the best ways to get the lowest price for your hot insurance is to shop around first. Also, keep in mind that if you insure for lower rates and the insurance company can’t provide quality coverage, the lower premiums won’t help you much.

Your commercial hot shot insurance quote will mostly depend on underwriting factors such as:

- Location

- Age of the driver

- Motor vehicle record or MVR

Hot Shot Insurance Discounts

How to Save Money on Your Hot Shot Insurance Premiums

- If you pay the entire annual premium at once you can save money, instead of only paying in monthly installments.

- You can reduce your annual premium by opting for a higher deductible amount, i.e., the amount paid as a payout after an accident. However, this will cause the payout amount in the case of an accident to be much higher.

- A lower limit does not really protect you in the case of a huge loss; however, you can save on the amount of premium you pay. But, you must follow the minimum limit laws mandated by your state.

- Insurance companies vary in how they determine risk, which is why prices vary. So, it is a good idea to compare the policies offered by various companies to find the best big rig insurance.

Insurance Discounts For Big Rigs

- By paying the entire premium amount at the start of the year, you can save up to around 25% on the premium amount compared to if you pay in monthly installments.

- You can check with your insurance specialist for discounts and the ones you qualify for, such as safe driver discounts, veteran discounts, bundled coverage, discounts for installing GPS and other safety devices in the big rig, etc.

How Can I Save Money on Hot Shot Trucking Insurance?

You can save money on your premium for hot shot trucking insurance in the following ways:

- You can raise your deductible limit to save money if you have sufficient cash reserves.

- Ensure that your policy mentions your radius of operations, especially if you do not travel beyond 500 miles or go outside the state.

- Paying via ETF transfer can reduce your fees on processing.

- By paying the entire premium amount in full, you can save money.

- Comparing prices at various brokers can help you negotiate the best coverage cfor the lowest truck insurance cost.

Hot Shot Trucking Insurance Discounts

- You can get a 15% discount by paying in one big payment.

- You can get a 4% discount if you have trucking experience of more than 3 years.

- You can get a 2% discount with a commercial driving license.

So, if you have a hot shot trucking business, it is a good idea to get your trucks covered to protect you from losses in case of any accidents or other incidents.

Are you still confused about hot shot insurance, or do you need some help getting a quote for your business? Contact us today and get all the information you need fast and for free!