Commercial Insurance: The Ultimate Guide

In a nutshell, commercial insurance protects businesses, including business owners and their employees. However, every business is different and has different coverage needs. Because of this, there is no one-size-fits-all commercial policy for business owners.

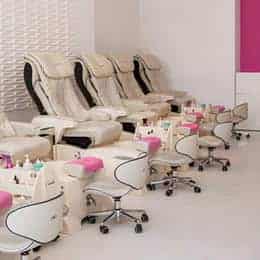

For example, an auto repair shop has different needs and risks than a beauty salon. That said, many business owners are confused with different commercial insurance coverage options.

Luckily, this guide will answer all the questions you might have about commercial insurance and how to choose the one that will suit your specific needs. Here’s what you need to know.

What is Commercial Insurance?

Commercial insurance is aimed at helping businesses and their owners stay protected against risks that may threaten their success. Depending on the type of commercial insurance policy, the coverage can be specifically aimed at protecting the reputation, wellbeing, or financial situation of a business entity, as well as the employees.

The main difference between commercial and personal insurance is that commercial insurance can cover multiple stakeholders and employees. Commercial insurance also tends to have much higher limits of coverage than personal insurance as there’s typically more physical property at stake.

Furthermore, commercial insurance plans are often created to cater to the personal needs of each business. On the other hand, personal insurance plans tend to have a more one-size-fits-all purchase process.

Many commercial business insurance policies include basic coverages such as property, liability, crime, and business insurance. Many commercial policies also include employee benefits such as dental, vision, disability, and group life insurance.

Types of Commercial Insurance

When choosing the best commercial insurance for your business, it’s important to know all the details before you opt for the one that will meet all your needs. Here are some of the most common types of commercial insurance:

Commercial Auto Insurance

This type of commercial insurance covers injuries that you or your employees may cause to other people and their property while driving. Usually, the commercial auto policy includes:

- Auto Liability

- Medical Payments

- Comprehensive Coverage

- Collision Coverage

- Uninsured/Underinsured Motorist Coverage

Equipment Breakdown Insurance

Equipment breakdown insurance policy is another form of commercial insurance that provides funds to repair or replace damaged machinery or equipment that has suffered a mechanical or electrical failure.

Public Liability Insurance

Public liability insurance covers your business for any claims made against you in which a customer is injured or their property is damaged as a result of your work. Most public liability policies also cover incidents that happen on your business premises or off-site.

However, be aware that commercial public liability policies are only valid for accidents that are unexpected and accidental. Also, public liability insurance doesn’t cover your employees.

Workers’ Compensation Insurance

Another type of commercial insurance is workers’ compensation insurance that is often required by law, especially for businesses in the construction, manufacturing, or engineering industries. This type of policy helps protect the company from lawsuits if there is a work-related injury and accident. Additionally, this insurance can help cover medical costs for an employee injured on the job.

Cyber Liability Commercial Insurance

Cyber liability insurance is a growing form of commercial insurance that covers businesses if there is a data breach or other type of cyber security threat. Because many businesses keep a great deal of personal information on their servers, being hacked can have lasting financial consequences.

Learn more about cyber liability insurance here.

Business Owners Policy (BOP) Insurance

Business Owners Policy insurance packages are a common solution for business owners because they may offer lower commercial insurance quotes if several policies are bundled together. While packages can differ from business to business, BOPs usually include property, general liability, crime, and inland marine coverage.

Business Interruption Insurance

This type of commercial insurance can be a smart investment in terms of commercial insurance. Business interruption insurance can help protect your business from financial losses in case a covered accident or unexpected event prevents your company from operating.

How Much Does Commercial Insurance Cost?

There are many factors that influence commercial insurance quotes. The most influential factors are:

- Profession: Not all businesses carry the same amount of risk. A business type that has higher risk can expect to pay more than a business with lower risk.

- Number of Employees: Businesses that have several employees can expect to pay more for commercial insurance because their potential for claims is higher than businesses with fewer or no employees.

- Coverage Needs: The amount of coverage you choose impacts your premium.

What is Commercial Umbrella Insurance?

A commercial liability umbrella policy provides an extra layer of liability protection by covering costs that might go beyond your other liability coverage limits. That said, commercial umbrella insurance complements other liability coverages by taking over when you reach other liability coverage limits.

For example, if you are liable for a customer who got injured at your place of business sues you for $1.5 million but you only have $1 million in liability coverage, a commercial umbrella policy could make up for the $500,000 shortfall, depending on the policy’s coverage limits.

In short, commercial umbrella insurance covers the same types of costs as business liability insurance, including medical expenses, attorney fees, and damages if your company faces a lawsuit.

Learn more about commercial umbrella insurance here.

How Much Does Commercial Umbrella Insurance Cost?

Generally, a commercial umbrella insurance policy with $1 million in coverage can cost a few hundred dollars annually. However, umbrella insurance isn’t offered as stand-alone coverage. Instead, it works together with your other commercial liability coverages, such as general liability insurance, which is among the most expensive insurance policies.

What Type of Small Business Insurance Do I Need?

The type of commercial insurance policy you need for your small business depends on the type of business you run. Another factor to consider is where your business is located. That’s why it’s always a good idea to reach out and talk to your insurance specialist before purchasing commercial insurance to make sure you have the type of coverage that meets your specific needs.

Here’s what you should consider when looking for commercial policies for your small business:

- Do you have employees?

- Do you create and sell products to customers?

- Do you have one or more company vehicles?

- Do you offer services to customers?

Finally, running your own business and being your own boss is a deeply satisfying and rewarding feeling. However, it can also bring its own set of responsibilities, regardless of the type of business you run. One of these challenges is deciding on which type of commercial insurance you need for your business. Whatever type of business you’re in, it’s always a good idea to make sure you are protected and covered by the right policy.

Did you find this article helpful? If so, you might be interested in finding out more about Business Owners Policy (BOP).

Businesses We Cover

Businesses We Cover

Auto Repair Shops

Beauty Salon

Churches

Cleaning Businesses

Construction Companies

Contractors

Grocery Stores

Handyman Services

Locksmiths

Manufacturing

Photographers

Plumbers

Restaurant

Retail Store