What You Need to Know About Data Breach Insurance

In today’s data climate, you can’t be fully confident with your computer system or network. Cyber attacks are constantly on the rise. As a small business with the right business insurance coverage, you can react quickly and effectively when the worst happens, so you are at a distinct advantage. In today’s environment, having the right insurance coverage can give companies a real competitive edge.

While there are many incidents of attacks on computer and communications systems and keep increasing daily, there are many other breaches or cyber-attacks that go unnoticed for months and even years until discovered. The source of attacks can be from outside or inside, which can be due to careless handling of data or information or weak security measures.

Since data breaches can no longer be prevented but can certainly be managed by having sufficient data breach insurance, it should be a standard component of a comprehensive insurance protection program for all business sizes. Businesses are potentially exposed to loss and reputational damage.

When a cyber-attack or data breach happens, the company should be ready to respond quickly to reduce any brand damage and legal liability. With cyber threats on the rise and the increasing cost of a data breach, many companies consider data breach insurance policy.

What is Data Breach Insurance?

Data breach insurance is a type of cyber insurance coverage purchased by the company to protect their financial interests in case of data loss. Data breaches occur due to various reasons, like hacking and poor cybersecurity procedures. Company’s stored data vary from simple to critical government information.

Difference Between Cyber Liability and Data Breach Insurance

You may find that insurance policies include more than one type of data breach insurance in some cases. This insurance coverage may also include network problems and cyber business loss, which usually depends on the depth and range of the policy. Other policies will cover intellectual property associated with a business. But most cyber liability insurance policies provide data breaches. Besides the extent of coverage, the terms are mostly interchangeable.

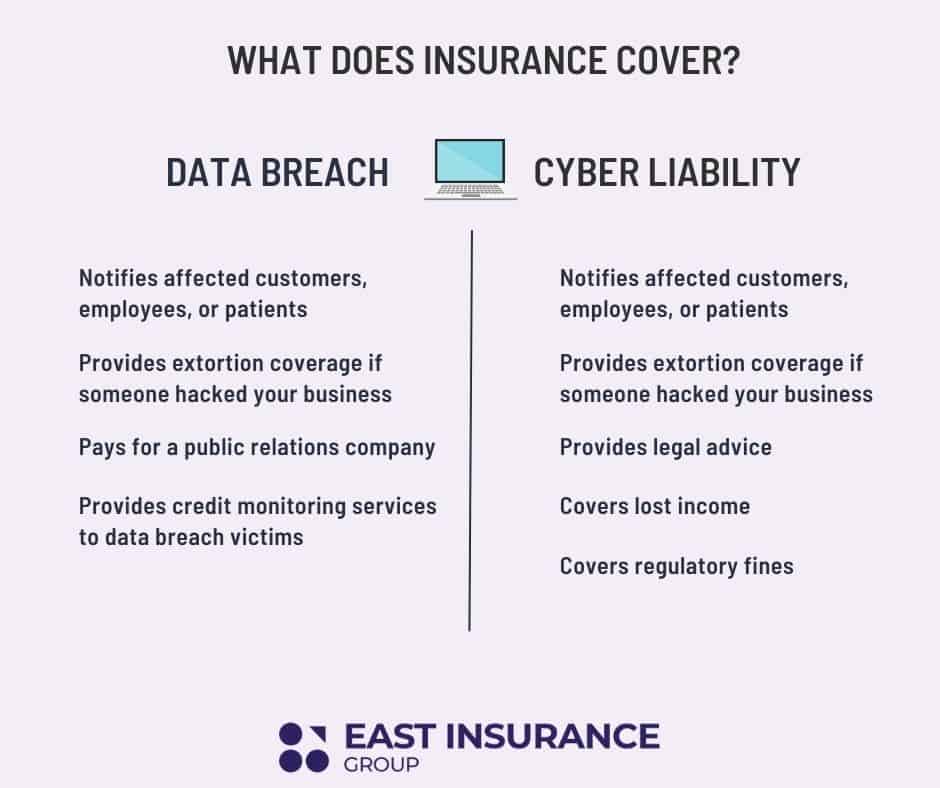

It is vital to know what small business insurance or general liability insurance covers. Data breach insurance and cyber liability insurance are different policies, but some of their coverage or benefits are similar. It offers access to the insurer’s cyber center to help understand data breach prevention and response resources. Both of these policies can protect your business in different ways.

Data Breach Insurance

Data breach insurance helps respond to breach in case PII or PHI is lost or stolen. It may be from a hacker breaking into your network or an employee leaving their laptop somewhere accidentally. If your business is the victim of a breach, data breach insurance can help pay to:

- Notify affected customers, employees, or patients.

- Hire a public relations company.

- Provide credit monitoring services to data breach victims.

- Extortion coverage helps cover the amount you paid if someone hacked your business’ data and asked for ransom.

Cyber Liability Insurance

Cyber liability insurance is requested for larger businesses. It covers financial damages due to cyberattacks or any tech-related risks, the same as privacy probes or lawsuits. If a hacker locks your computers, deletes some files, and demands a ransom, this liability coverage can help the company respond to the attack and help recover its lost files and income.

If you own a large company and cyberattack victim, cyber liability insurance can cover:

- Legal advice to help businesses comply with the state and federal regulations

- Notification expenses to warn affected customers of their compromised personal information

- Extortion paid to retrieve secured files in a ransomware attack

- Lost income due to network outage

- Lawsuits concerning client or employee privacy and protection

- Regulatory fines from state and federal agencies

Who’s Financially Responsible for Cybersecurity Breaches

As networks become less secure and more valuable data needs extra security, cybersecurity breaches are getting more expensive and in demand. In the first six months of 2019, data breaches compromised more than 4.1 billion records. IT experts and cybersecurity people cannot prevent every breach, so steps taken were not to protect data but to secure who would pay if the customer’s data gets stolen or compromised.

Breach Notification Laws

All 50 states have enacted legislation that requires a private business to notify individuals of security breaches that involve personally identifiable information. Usually, security breach laws have provisions regarding who must comply with the law, definitions of what is personal information, what constitutes a data breach, and exemptions.

What Happens When a Company Experiences a Data Breach

As business owners, for your company to experience a data breach can be frustrating and terrifying. Data breaches can jeopardize your financial data and identifiable information, resulting in identity theft and leaving you submerged in fraudulent charges. Hence, a data breach can be very bad news to any company that experiences it. It could result in the loss of customers and can affect the financial stability of your business. A data breach is something that you want to avoid at all costs.

Why Does Data Breach Occur

One of the most significant reasons why data breach occurs is the many cyber thieves’ access points due to different devices and networks that connect people and organizations. So a lot of companies are becoming more vulnerable than ever. Due to the rising level of risk and the increasing creativity and resourcefulness of hackers, it is crucial to always deal with potential threats and hackers. This includes understanding how the hackers get in and developing preemptive security measures in dealing with different entry points that they may use. By doing this, you can prevent and discourage a data breach from occurring as well.

Steps to Prevent and Minimize a Data Breach

When it comes to prevention, there are multiple levels of security that you should consider.

- Software and Firmware: Your antivirus, operating system, and hardware like routers and modem. You need to make sure that they are protected.

- Monitoring: It is also crucial that you have monitoring solutions in place to keep an eye on your systems at every level.

- Have a Plan: To make sure that you have the right systems in place, be prepared with a plan. In this way, you can be alert on how to respond in case a breach happens. This includes alerting everyone who is affected, such as changing passwords and bringing security experts.

- Keep Perfecting: Do not just settle on a “good enough” protection, but keep testing and trying to perfect your security measures, more particularly if you are making changes to your systems and applications.

- Peripheral Systems: Don’t lose sight of the systems in your periphery. It may include anything from mobile apps to the cloud. While they are easy to forget, they can be an easy target for hackers, so don’t neglect them to secure the systems.

- Purge your data: Purge your system regularly for unnecessary data. Make sure you are storing data to a minimum, as it is an effective measure to take in. This is to make sure that it does not get into the wrong hands.

- Choose the Right Cloud Service:Another important way to ensure you have efficient security systems is to choose the right cloud service. It is an important consideration to make sure that they have good backup and disaster recovery plans. Having enough knowledge of your cloud service and the strategies they incorporate are necessary to prevent a data breach from happening in your small business.

- Follow the PCI Compliance Standards: Plenty of hard work has been added to help small businesses secure their data cardholder, such as 12 mandated PCI DSS Standards. These standards were set how cardholder data must be separated and at the same time stored, while obeying the PCI standards, giving your firm a good and better framework.

How Much Does Cyber Liability Policy Cost

The average cost of a cyber liability policy in 2019 was $1,500 per year for $1 million in coverage. Several factors impact the cost of the policy, including:

- Size and industry

- Amount and sensitivity of data

- Annual revenue

- Policy terms

Finally, from physical security breaches, phishing attacks, password breaches to keystrokes and ransomware, there are many types of data breaches that can seriously hurt your business and even close it for good.

For example, even some of the most skilled people in your organization may let their guard down and accidentally send a sensitive file to someone outside the company. In these situations, data breach insurance would cover the costs of potential claims or other types of consequences we mentioned above.

Did you find this article helpful? If so, make sure you also read more about intellectual property insurance!

Get A Quote And Get Coverage Today

Our Insurance Specialists are ready to help you out.