Commercial Truck Insurance: The Ultimate Guide

Commercial truck insurance is a group of specific auto insurance policies created to cover the specific needs of your business. Usually, basic commercial truck policies cover your trucks in case of an accident.

Commercial truck insurance in Texas is no different. In Texas, the law requires local truckers to have some liability insurance. This article will teach you how much insurance you need, how much it costs, why you need it, and what commercial truck insurance in Texas covers.

What Is Texas Trucking Insurance?

Commercial semi-truck insurance in Texas is essential for owner-operator trucking services. Similar to buying auto insurance for your personal vehicle, commercial truck insurance combines collision, liability, and comprehensive policies. However, unlike personal auto insurance, commercial truck insurance in Texas needs higher coverage limits to account for more valuable vehicles and the cargo they haul.

The insurance package business owners choose usually includes several types of coverage. That’s why it is important to understand commercial truck policies before deciding on your Texas trucking insurance.

What Does Commercial Truck Insurance Cover?

Trucking Auto Liability Policy

In Texas, it’s required that commercial trucks have liability insurance. Trucking liability insurance covers you from liability risks in case you or your driver are involved in an accident and are responsible for it. Liability insurance covers bodily injury claims, medical bills, and property damages during the collision.

In Texas, the Department of Transportation requires commercial truck drivers to carry insurance coverage that ranges from $750,000 to $1,000,000. The insurance amount depends on the vehicle’s size, the distance it travels, and the type of cargo it hauls.

Trucking Cargo Coverage Policy

Trucking cargo coverage is a type of inland marine insurance covering goods and property that the truck transports. Cargo insurance covers your client’s cargo in case it gets stolen or damaged.

The Federal Motor Carrier Safety Administration, or FMCSA, states that all trucking companies carry trucking cargo insurance of $5,000 per vehicle.

Physical Damage Policy

This policy covers vehicles from different types of perils, such as vandalism, collision, and fire. The liability coverage only covers care of injuries and auto repairs for everyone injured due to the fault of your truck driver.

Uninsured Motorist Coverage

Uninsured motorist coverage reimburses you for any damages and injuries to you or your employees if the other driver is found responsible for the accident but has no insurance.

Read More: The Complete Guide To Commercial Auto Insurance

Types of Commercial Trucks Policies

There are a number of kinds of commercial truck policies. As mentioned above, a commercial truck policy includes different types of coverage, such as:

- Semis (tractor-trailers or 18-wheelers)

- Dump trucks

- Garbage trucks

- Car haulers and auto trailers

- Tow trucks

- Flatbed trucks

- Tank trucks

- Box trucks

How Much Does Commercial Truck Insurance Cost in Texas?

Typically, truck insurance in Texas costs $13,606 per year. Many factors impact the cost of cheap commercial truck insurance, including:

- The type of cargo you’re hauling

- Your driving history

- How long you’ve been driving

- The deductible you choose

A Real Example of Commercial Truck Insurance in Texas

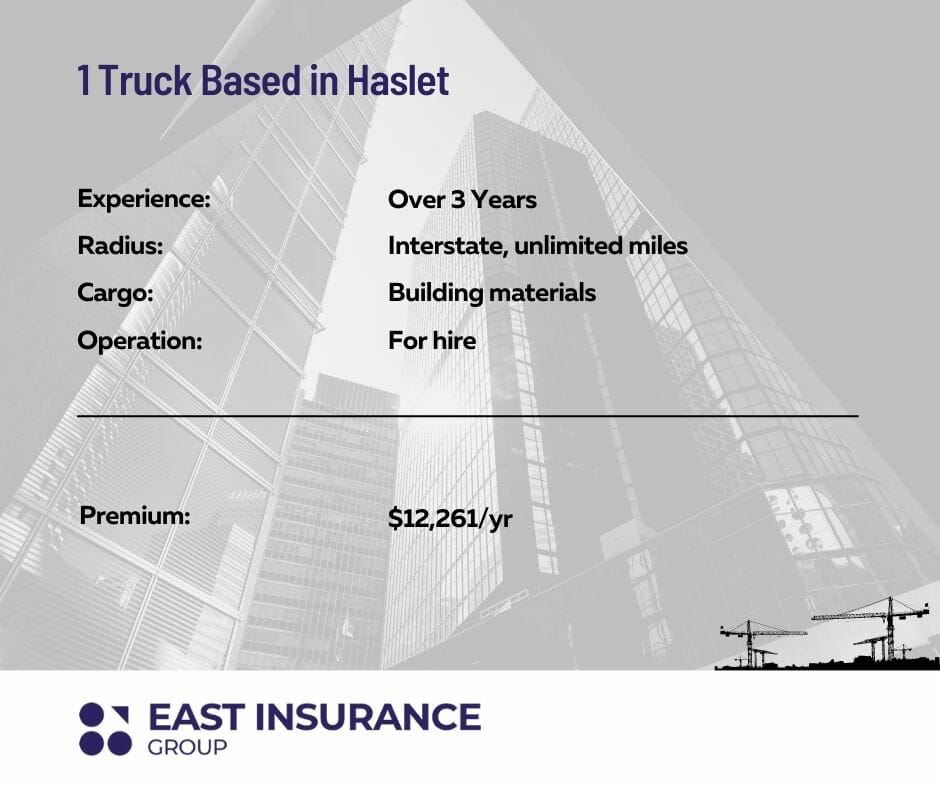

Above you’ll find several factors that impact the price of commercial 18-wheeler insurance in Texas. While you can’t control the number of years you’ve been in business, you can choose the best quote you get from insurance companies. Here is an example quote that will help you understand how a premium is calculated in Texas above.

How Does Commercial Truck Insurance Work?

Now that you have chosen the right quote from an insurance agency you can trust, make sure to gather up these documents help your agent calculate your quote quickly:

- Current policy declaration page

- Driver’s license numbers

- Driving history for all the truck operators

- The vehicle identification number or VIN for all your vehicles

You should also ensure that all this information is accurate to obtain realistic quotes.

Texas Commercial Truck Insurance Requirements

According to Texas law, local truckers must keep some liability insurance. If you don’t cross state lines, you need to get a TXDMV Number and keep the following minimum amount of liability insurance:

Get East Insurance Group Policy in All Texas Cities

East Insurance Group is an independent agency that chooses only the best carrier for your specific insurance needs. Besides providing you with the best service and quotes, East Insurance Group is available wherever you are in Texas, including (but not limited to)

- Houston

- Sant Antonio

- Dallas

- Austin

- El Paso

- Garland

- Brownsville

- Amarillo

- Waco

- Tyler

- Allen

- San Angelo

- Frisco

Read More: The Guide to Business Insurance in Texas

Who Needs Commercial Truck Insurance in Texas?

Every business owner who owns a truck and uses it for business purposes should consider having commercial truck insurance. It doesn’t matter if you have a fleet of trucks or only one truck you use for work, the risk of getting in an accident that could cause extreme financial damages is real and possible.

If one of the following statements applies to you, you should consider having commercial truck insurance:

- You own or operate a commercial truck

- Your truck is used for commercial purposes

- You are a trucking contractor

- You haul cargo or passengers in your truck

Are you still confused about commercial truck insurance in Texas, or do you need some help with getting a quote for your business? Contact us today and get all the information you need fast and for free!