If you are a medium or small business owner, pay-as-you-go workers’ comp insurance might be something to consider. Most states in the USA require businesses to have workers’ comp insurance. But more importantly, workers’ compensation insurance safeguards your business from unforeseen circumstances. Here is what you need to know about this type of insurance that protects you in case an employee gets hurt on the job or falls sick.

What is Pay-as-You-Go Workers’ Comp Insurance?

Pay-as-you-go workers’ comp insurance covers your business in case any of your employees get injured or sick. Because there are many different ways your employees could get hurt or sick, having workers’ comp insurance is always a good idea when it comes to covering unforeseen fees and claims.

Pay-as-you-go workers’ comp insurance allows companies to pay monthly premiums based on their monthly payrolls. Earlier, companies had to project their annual payrolls and pay a yearly premium.

Since the premiums were paid on projections and not actual income, companies paid too much money. Traditional worker compensation insurance required you to pay a heavy down payment. It would be as much as 25% of the whole amount. This payment method caused companies to pay extra money.

Whether the company makes more money or less, the premium remains the same. The pay-as-you-go model allows an employer to adjust the premiums according to monthly payrolls—companies belonging to the service sector benefit greatly from this method.

Since there is no upfront payment, companies can save this money or reinvest it in their business. The pay-as-you-go workers’ compensation works best for people who own restaurants or are part of the cleaning industry. These industries hire rotational employees based on the demand.

Suppose you have 3 employees in the first month. That means you only have to pay a monthly premium for each employee. If you have 1 employee in the next month, you have to pay a monthly premium for one employee. Traditional workers’ compensation insurance does not allow you to change the premiums based on your employees. No matter how many people you hire or fire, you have to pay the same amount of premium each month. It doesn’t mean you lose money.

The insurance company later refunds the amount that is not utilized. But this is only done after the annual audit. It indicates whether your business is doing well or not; you have to keep paying a fixed premium from your pocket.

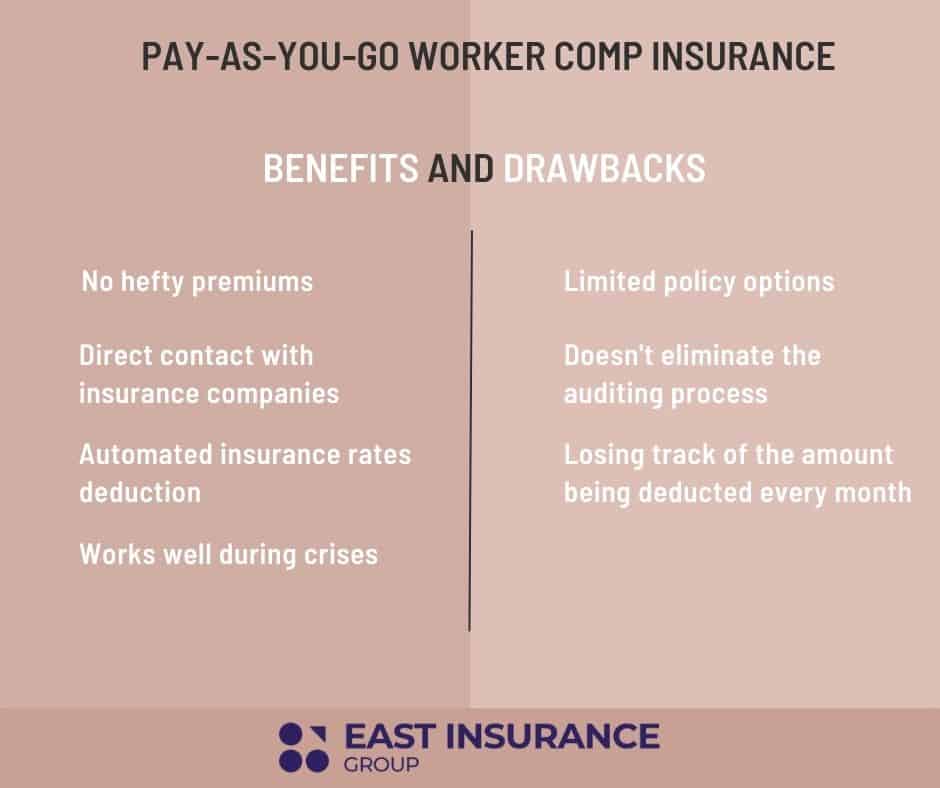

Benefits and Drawbacks of Pay-as-You-Go Workers’ Comp Insurance

Pay-as-you-go workers’ compensation allows you to get insurance without a hefty premium. And since it will enable you to pay according to your income, you don’t pay extra money. The money saved from this can be used for marketing your business or hiring another employee. The pay-as-you-go worker compensation has changed the face of worker’s compensation insurance.

Businesses can get directly in touch with insurance companies that provide pay-as-you-go workers’ comp insurance. You can also get in touch with your payroll company, which will then connect to your insurance company. These two agencies will communicate with each other and adjust the premium amount each month. It means you no longer have to worry about making monthly payments yourself.

The insurance rates will be adjusted and automatically deducted from your account. This amount will be based on the number of employees and other variable factors. Since you no longer have to pay extra money each month, you will increase your profits. These additional funds can be used to build your business further. Because of this, healthcare companies, construction businesses, and landscaping companies can benefit from this model. Pay-as-you-go workers’ compensation is also excellent for service-based industries.

Since these companies hire employees temporarily, they only have to pay a premium for the current employee. The monthly premium amount for each employee gets automatically deducted from your account. The monthly premium is based on actual income instead of projections, which makes the auditing process simple. The additions or deductions are also more accurate.

Traditionally, premium payment was based on forecasts. It made the auditing process extraordinarily complicated and less accurate. With the pay-as-you-go worker’s compensation, you know the exact amount. Of course, this figure fluctuates during an audit, but not as much as it does with traditional workers’ compensation insurance.

Pay-as-you-go worker’s compensation works well during a crisis. Every business has good and bad days. When the money is flowing, you don’t have to worry about premiums, but it is a problem if the cash flow is slow. If you choose the pay-as-you-go workers’ comp, you end up saving cash. You can use the saved-up money in supporting the business during a crisis.

On the other hand, there are some drawbacks when it comes to pay-as-you-go workers’ comp insurance. Even though the pay-as-you-go model may sound perfect, it has a few drawbacks. Many payroll companies work with a single insurance agency. As a business owner, you do not have the freedom to choose from several insurance policies.

Another disadvantage is that you don’t get to compare policies. Your options in terms of policies become limited. Even though the numbers are based on actual income, your company will still need an audit.

Pay-as-you-go workers’ compensation insurance does not eliminate the auditing process. Business owners also lose track of the amount being deducted every month.

Since everything is automated, it is easy to forget that the premium cost increases with each hire. These disadvantages are pretty trivial. You can easily keep a check on these things.

How Much Does Pay-as-You-Go Workers’ Comp Insurance Cost?

For some, workers’ comp insurance can be very expensive. Generally, insurance rates go from $0.74 to $2.74 per $100 of employee wages. If you have ten employees and your coverage is on the lower end, let’s say $0.80 per $100 of employee wages who will earn a combined total of $450,000, you divide the total wages by $100 and get $4,500. To get the annual cost of your workers’ comp insurance, you multiply $4,500 by the insurance rate and get $3,600. With pay-as-you-go insurance, you can pay each time you run payroll instead of paying the whole amount at the beginning of each billing cycle.

Pay-as-You-Go Workers’ Comp vs. Traditional Workers’ Compensation Insurance

Pay-as-you-go workers’ compensation insurance helps businesses save money in the short term and the long term. It saves you from spending a considerable amount of money and allows you to invest it later on during your business journey. Also, hiring employees increases the premium amount each month. The auditing adjustments are much more minor. When you lose an employee, your premium amount goes down. This way you don’t have to worry about paying extra money. Make sure to consider this when you choose pay-as-you-go workers’ comp insurance.

Traditional workers’ compensation requires you to pay a hefty down payment. Whether you lose or gain an employee, the monthly premium amount remains the same. Since the premium is based on projection, the numbers are not always accurate. Still, this type of policy requires significant auditing but if there is a difference in the amount paid, you receive a refund.

How to Calculate Pay-as-You-Go Workers’ Comp per Employee?

One of the first things you could do to learn how much the policy would cost would be to contact an insurance company and ask for a quote. There are many factors and variable insurance companies look at when determining costs for a specific business, but there is a basic formula for estimating workers’ comp costs for an employee, which is:

(Annual employee payroll/100) x workers’ comp insurance rates = estimated costs.

Is Pay-as-You-Go Workers’ Comp Insurance for Me?

If you own a small business, there is a big chance that this type of policy is a great option for you. This is especially true for businesses specializing in cleaning or commercial and institutional construction companies that often hire new employees. Pay-as-you-go workers’ compensation is also suitable for foodservice businesses and healthcare or landscaping service-based businesses.

Finally, pay-as-you-go work comp insurance is available in 46 states. If you own a business in Washington, North Dakota, Wyoming, or Ohio, you won’t be able to use the pay-as-you-go method. At the end of the day, this policy has more pros than cons and it helps you maintain your annual budget and increase your monthly profits.

Still not sure about getting insurance? If you have any questions or you feel confused about any part of this article, make sure you contact an experienced insurance agent who will gladly provide answers and solutions for your specific business needs.

- EIG Adminhttps://eastinsurancegroup.com/author/admin-2/

- EIG Adminhttps://eastinsurancegroup.com/author/admin-2/

- EIG Adminhttps://eastinsurancegroup.com/author/admin-2/

- EIG Adminhttps://eastinsurancegroup.com/author/admin-2/