Workman’s Comp Insurance in PA: All You Need to Know

Pennsylvania workers can ease up thinking about what would happen to them if they get injured or sick while on duty at work because they can rest assured that they are protected with workers’ compensation insurance coverage. Those who are doing business in Pennsylvania, whether it is a big or small business as long as they have one or more employees, must have workers’ compensation insurance. This PA workman’s comp policy is not just for the good of the employees but also for the employer and the business.

Having business insurance and workers’ comp insurance in PA is essential because it will save the employer so much money if an unwanted situation occurs, such as an accident or an injury while his employees are at work. Pennsylvania workers’ compensation is required by the law and here is everything you need to know about it.

What is Workman’s Comp Insurance PA?

Workers’ compensation PA offers coverage for sick, injured, or dead employees due to some work-related cause. Pennsylvania workers, whether full-time or part-time, have workers’ comp insurance. Part of its coverage are:

- Restoring a percentage of the income that was lost in case the employees need time to heal and recover

- Death benefits

- Costs for medical treatment and other medical expenses

As for the business owner’s advantage, workers’ compensation coverage may include legal fees that can be potentially used should the employees’ families sue the business for the accident. Workers’ compensation Pennsylvania helps injured workers to pay for their medical treatments and reimburse some income lost while they are recovering. Workers’ compensation insurance can also help employees pay for their hospitalization in case of a car accident while they are on duty. Also, part of this compensation coverage is that if the worker sustains carpal tunnel syndrome, it provides to pay for the ongoing treatment and replace the income lost while the employee is undergoing some treatment.

The main essence of Pennsylvania workers’ compensation is to offer a safe work situation for the Pennsylvania employees such that when they encounter an accident or injury. At the same time, they do not have to worry about the medical costs and also lose salary while they are away from work to heal. Workers’ compensation insurance PA is definitely a very important aspect of a business.

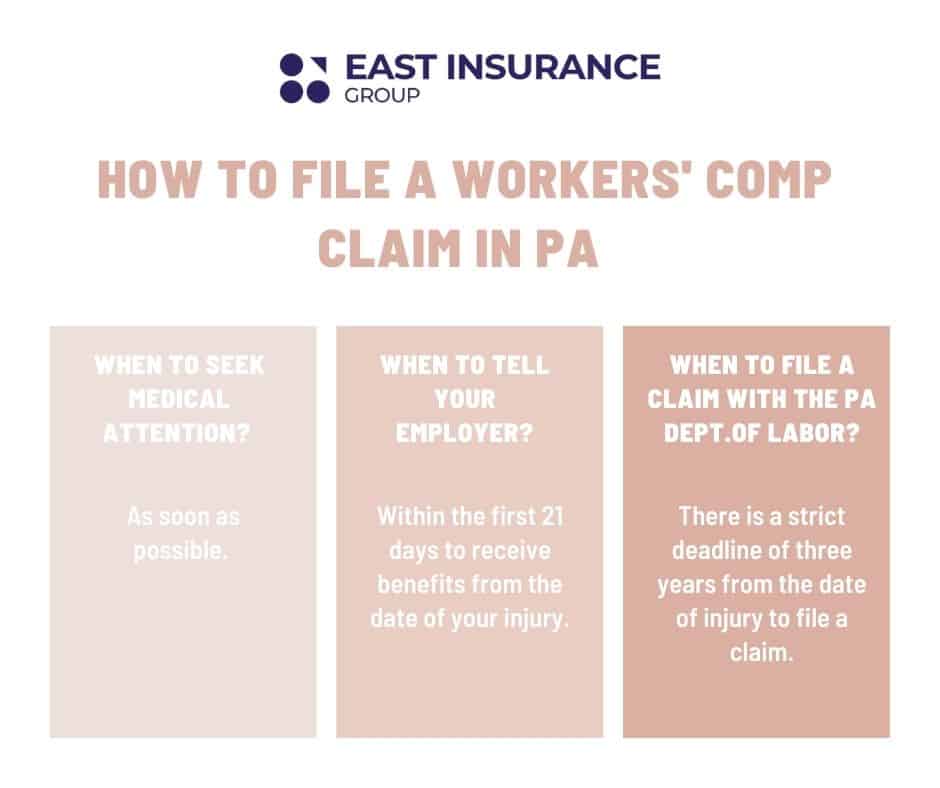

Check the graphic below to learn more about how to file a workers’ compensation PA claim:

Are PA Employers Required to Have Workers’ Compensation Insurance?

Workers’ compensation insurance in PA is required by law for most employers. Employers who don’t have workers’ comp insurance may be subject to lawsuits by employees and to criminal prosecution.

What are the Penalties for not Having Workers’ Comp Insurance in PA?

In PA, employers can face civil and criminal penalties for failing to have adequate workers’ comp insurance. In case it is found that an employer doesn’t have the coverage, everyone who is responsible for that could be criminally charged. The responsible person could be found guilty of a misdemeanor and carry a fine up to $2,500, as well as a year in jail.

What are Exemptions from Workers’ Comp Insurance in PA?

Though most employees are covered by workers’ comp insurance, there are some exemptions. Part of those who are not eligible for Pennsylvania workers’ compensation insurance are longshoremen, federal employees, and railroad workers as they are insured in other compensation acts.

PA State workers’ comp also doesn’t apply to those who work in the agriculture industry and earn no more than $1,200 for the whole calendar year or those who work less than 30 days. Compensation insurance may also exempt individuals due to their religious beliefs or their corporate status.

Workers’ comp insurance also exempts those who work from home, licensed real estate representatives, and independent proprietors with an unincorporated business and without employees.

What Does Workman’s Comp Insurance PA Cover?

Workers’ comp insurance in PA is a highly essential matter because an employer could be exposed to criminal prosecution without this kind of insurance. Some of workers’ comp coverage includes:

- Medical costs and continuing care include visits to the doctor, laboratory tests, surgery, medicine, therapy, etc.

- Payments for partial disability allow the workers to get some compensation even if they cannot work in their full capacity.

- Payments for total disability allow the workers to get some compensation though they cannot return to work anymore.

- Compensation for permanent injury allows the workers to get paid as a consequence of a lost body part.

- In case of death, benefits may be given to the spouse or a minor dependent. This can be given if a worker dies from work-associated sickness or injury within about 300 weeks following an injury.

How Much is Workers’ Comp in PA

It is estimated that workers’ comp insurance rates in PA are $1.35 per $100 in covered payroll. The costs depend on a number of different factors:

- Location

- Payroll

- Number of employees

- Industry and risk factors

- Claims history

- Coverage limits

People working in Pennsylvania are covered by the workers’ compensation insurance from the first day that they start working on their jobs. This worker’s compensation is in effect for the whole time that the individual is employed in the company. This insurance is also valid even if the staff has a preceding physical condition.

To avoid legal risks and complications, employers must communicate with an insurance representative to discuss what type of business insurance and compensation insurance PA are most appropriate for their workers. Talking to a knowledgeable and trustworthy insurance agency is the best way to find the most suitable workman’s comp insurance in PA for your industry and the perfect coverage for your staff. Contact East Insurance Group and get your free quote today!

You may would like to get know more about contractor insurance in PA.

Get A Quote And Get Coverage Today

Our Insurance Specialists are ready to help you out.