Flatbed Truck Insurance: Everything You Need to Know

If you are the owner of a flatbed truck or trailer, the challenges you face are unique — and so are your insurance needs. You require protection for the 48-foot trailer itself. In the event of physical damages to your vehicle, the financial loss would be devastating if you are financing it. You may have acquired the trailer at a price anywhere between $20,000-30,000 and it might be one of the most valuable assets in your trucking business.

Finding the right coverage plan for it becomes extremely significant since a flatbed trailer faces numerous critical risks.

Here’s everything you need to know about flatbed truck insurance.

Types of Bobtail Coverage

Security of Securement

A massive machine, the flatbed trailer requires attention to load securement. This is crucial because freight can easily fall out of the truck and cause immense damage on the road. The FMCSA has formulated a series of rules, regulations, and guidelines for safe practices for cargo securement.

Secondly, you can also get injured while securing or removing the load in case you slip off the trailer. In both these cases of injury to others or self, it is important that you be covered with cargo insurance and other policies.

Hazardous Goods

Flatbed trailers are not easy to navigate on the road. Often, they carry potentially dangerous freight and the loads are enormous. While traversing rocky, bumpy terrain, there is a chance that the freight may offload and cause serious damage. As the owner, you need to protect yourself against the liability for such damages.

Stolen Goods

Flatbed trailers haul goods in the open and face a much higher risk of theft. The goods could be stolen much more easily than in any other kind of covered truck and trailer. The expensive equipment and parts of the truck could also be tampered with and stolen. It is necessary to ward off the possibility of loss due to this circumstance.

Running Empty

Due to their immense size, when flatbed trucks run empty, they become lightweight and can get imbalanced. While going through slippery or uneven surfaces, if the trailer dives down, it could get seriously damaged and also cause injuries to the driver and the public. It is important to have the foresight to be protected against such risks.

What is Considered a Flatbed Truck?

A flatbed truck is a large vehicle with a flat body, without a roof or sides around the bed. Usually, these trucks are used to haul heavy loads that won’t be compromised in bad weather or on rough roads. Flatbed trucks have a unique bed design that is perfect for loads that would be too wide for trucks with enclosed bodies.

What is Covered by Flatbed Truck Insurance?

Flatbed trailers haul huge and often dangerous freight, including metals, pipes, beams, and heavy machinery. Cargo spills and other casualties are not uncommon with the vehicle. The policy is an assortment of various types of flatbed truck insurance that comprehensively protect you against damage, loss, and injury liabilities.

- Liability Insurance: This is mandatory and covers damages to others’ property in the event of an accident by the flatbed truck driver. Without this fundamental coverage, it would not be possible to run the trailer on the road and haul goods.

- Physical Damage: Protects against damages to the trailer in the case of a collision. It can also cover fire and theft. In some cases, an interception on highways by motorists, other vehicles, or even deer can cause the trailer to collide.

- Securement Coverage: This is a specific insurance plan only for flatbed trucks that protects the equipment that secures the cargo, including the ramp, chain, tarp, and binder.

- Flatbed Cargo Insurance: This is a crucial part of the flatbed truck insurance pie. It covers damages done to the goods being hauled. In many cases, the cost of the goods is enormously high, and the insurance amount must match that. If a particular load requires higher coverage than you have, you can procure a temporary coverage certificate and assure the shipper.

- Trailer Interchange: This is coverage in the situation where you own the tractor, but also haul freight in various flatbed trailers owned by other companies. This is important or it may lead to you being solely responsible for liabilities in the case of an untoward event.

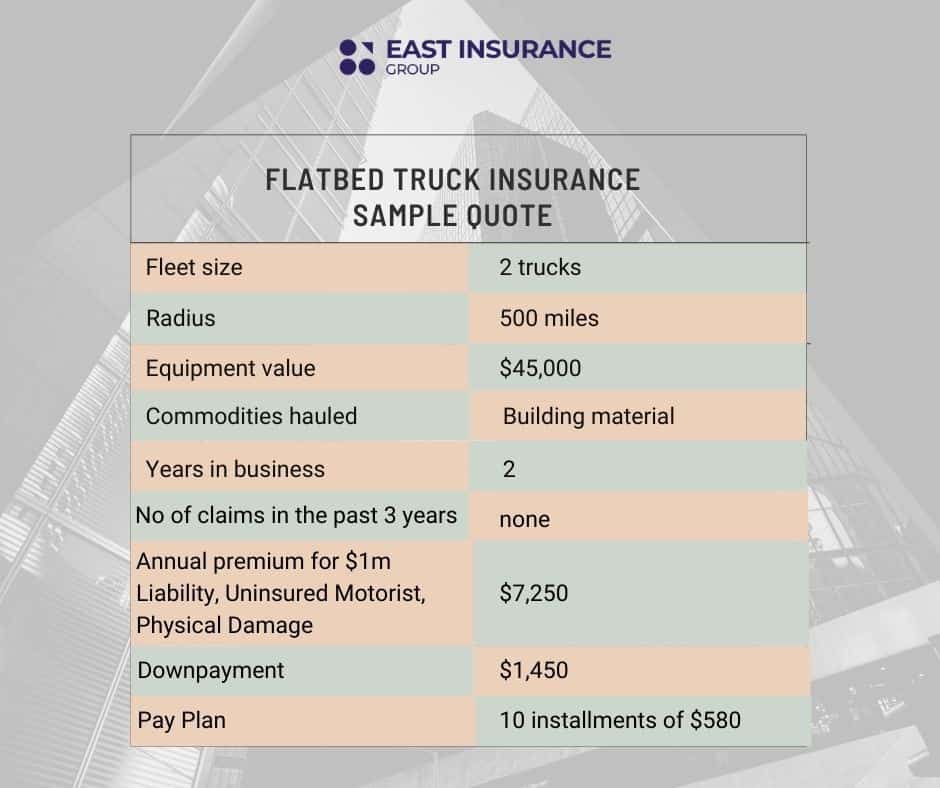

How Much Does Flatbed Insurance Cost?

Flatbed truck insurance coverage costs between $7,000 to $12,000 peryear.

It varies according to the value of the tractor and flatbed trailer, the kind of freight being hauled, your service areas, your driving experience, and your records. It is important to consider the costs, deductibles, and coverage limit to pick an insurance policy that best suits your needs and would cover liabilities under all circumstances.

How to Save on Flatbed Truck Insurance

Finding the cheapest commercial truck insurance can be difficult for some. One of the best ways to save money on the flatbed truck insurance cost is to shop around and find the best policy for your needs.

Ideally, though, you must not focus on saving money while getting an insurance package for your flatbed truck. Instead, we always go for a combination of valuable service, comprehensive coverage, and cost-effective premium.

Companies like East Insurance Group can help you develop tailored insurance packages for the commercial truck you have. It is much better than getting a general insurance package, which may not have the extensive coverage options that you are looking for.

By creating a tailored plan, you can also save money to reduce the premium per month.

Tailored Insurance for Your Needs

Our leading insurance specialists at East Insurance Group advise you after considering the variable costs and complex assortment of protection required for flatbed truck and trailer insurance.

Experienced professionals are at your disposal to discuss, review and provide the best insurance that covers you against all possible liabilities for damages, loss and injuries, considering the unique risks posed by the flatbed trailer.

Do you Need Insurance for a Flatbed Trailer?

If you use your flatbed trailer for commercial purposes, you will most likely be required to have insurance. Besides being required by the law, flatbed trailer insurance is also recommended to avoid liability risks and losses.

Risks Flatbed Haulers Face

- Loading and unloading risks

- Walk-up thefts

- Running empty

- Carrying dangerous cargo

- Need for advanced load securement strategies

What are the Benefits of a Flatbed Truck?

Taking Fewer Trips

Flatbed trucks are bigger than pickup trucks which means you have more room to store everything you want to move in one take.

You Can Load More

You can load almost everything onto a flatbed truck as it is able to withstand the weight of huge objects and deliver them safely.

It’s Easier to Load a Flatbed

Because flatbed trucks provide more room, it’s easier to load them. Furthermore, flatbed trucks don’t have walls like pickup trucks, so it’s easier to load items from any side and angle.

Are you still confused about flatbed truck insurance, or do you need some help getting a quote for your business? Contact us today and get all the information you need fast and for free!

Trucking Coverage

- EIG Adminhttps://eastinsurancegroup.com/author/admin-2/

- EIG Adminhttps://eastinsurancegroup.com/author/admin-2/

- EIG Adminhttps://eastinsurancegroup.com/author/admin-2/

- EIG Adminhttps://eastinsurancegroup.com/author/admin-2/