Commercial Property Insurance in Florida: What Is It, Costs, and Benefits

Families and individuals usually buy homeowners insurance, while businesses opt for commercial insurance to protect their assets. At East Insurance Group, you can buy both policies, specifically created according to your needs.

When it comes to commercial property insurance, this type of policy is usually more complex than the one that covers individuals and families. That said, commercial property insurance covers much more, such as covering commercial buildings against loss caused by fire, storm, or other perils. It also covers your inventory and even income in some situations.

The same goes for commercial property insurance in Florida.

In this article, we will talk about commercial property insurance in Florida, how much it costs, the benefits of having this policy, whether it is required, and more!

What is Commercial Property Insurance in Florida?

Florida commercial property insurance covers stolen, lost, or damaged business property. The policy is especially useful as it covers the business’s physical location and equipment. However, to make Florida commercial insurance legitimate, the loss must occur in the location listed in the policy.

The loss also must result from a covered cause of loss.

Why Do I Need Commercial Property Insurance in Florida?

Commercial property insurance in Florida is beneficial as it covers your business against the risks of owning and/or renting business property. This policy covers different types of property losses, and it insures expensive equipment and inventory.

Read more: The Ultimate Guide to Business Insurance in Florida

What Does Commercial Property Insurance in Florida Cover?

Commercial Property Insurance

Commercial property insurance covers business owners in case of flood, hail, windstorm, earthquake, vandalism, tornado, and other perils.

Commercial Building Insurance

This type of policy insures the covered building. The commercial property can be insured at Replacement Cost (RC) or Actual Cash Value (ACV).

Usually, business owners opt for Replacement Cost as it rebuilds the building/ replaces the items and property without depreciation. On the other hand, an Actual Cash Value policy depreciates the building.

Business Personal Property

This type of insurance policy covers the equipment and furnishings.

Inventory

This covers business inventory and may include reasonable adjustments.

Other Structures

This covers structures not permanently attached to the building, such as fences or other buildings on the property.

Business Income

This covers loss of income for businesses, including lost profits and expenses when the business was closed.

Package Policy

This covers enhancements like electronic and data recovery, sign coverage, and employment practice.

Read more: Homeowner’s Insurance in Florida

What Does Commercial Property Insurance Not Cover?

Commercial property insurance in FL covers many items, but the standard policy does not cover some things. In these cases, you will need additional coverage or maybe a different policy. Here’s what commercial property insurance in Florida doesn’t cover:

- Vehicles held for sale

- Costs to research and restore information on valuable documents

- Bills, food stamps, accounts

- Underground pipes or drains

How Does Commercial Property Insurance in Florida Work?

In some cases, especially with small businesses, commercial property insurance is a part of a business owner’s policy (BOP). A BOP typically combines commercial property insurance, general liability insurance, and business interruption coverage. Furthermore, buying the policies in a bundle can be cheaper than buying them separately.

If this confuses you, feel free to contact one of our experienced and trusted agents anytime. People choose East Insurance Group because they know our agents will provide them with any information they need – from quotes to answers related to their specific businesses – in less than 24 hours.

How Much is Insurance for Commercial Property Florida?

The median cost of commercial property insurance is $58 per month. The cost is influenced by various factors, including:

- Location

- Type of business

- Property value

- Safety measures

- Deductibles

- Policy limits

To lower the costs, many small businesses buy business owner’s policy or BOP that combines several policies (commercial property insurance and general liability insurance) instead of buying policies separately.

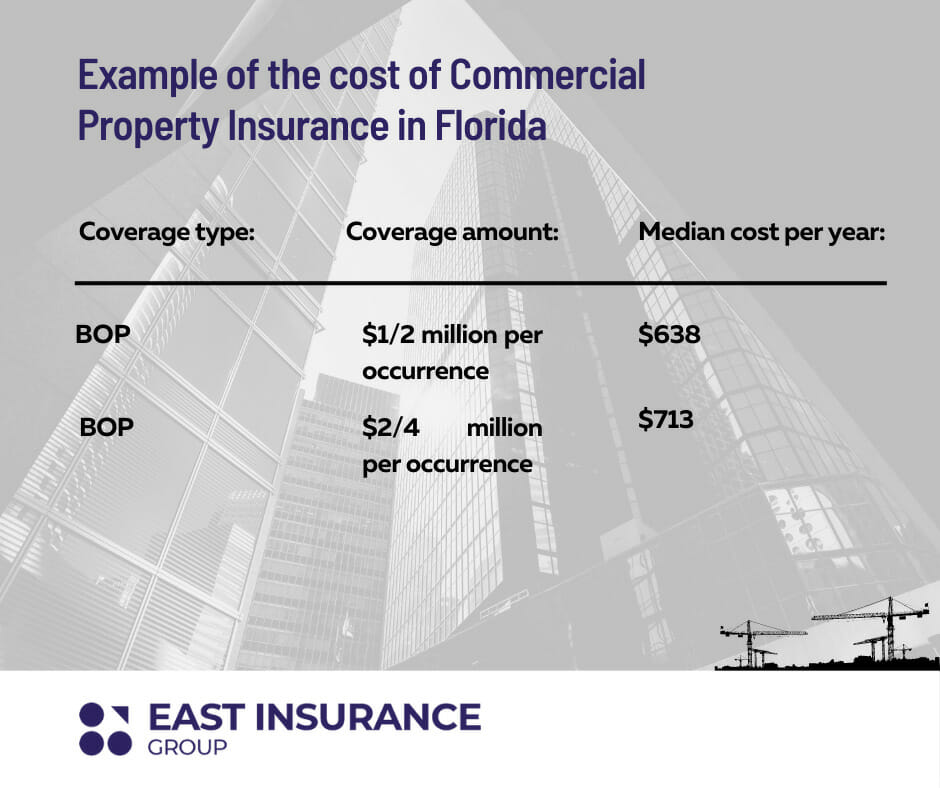

Here is a real example of the cost of commercial property insurance in Florida:

Is Insurance Mandatory for Commercial Property in Florida?

In Florida, physical property such as an office, a store, or a restaurant and all the contents inside must be insured by commercial property insurance.

Which Industries Often Purchase Commercial Property Insurance in Florida?

While Florida requires all businesses that own property to carry commercial property insurance, some industries need this policy more, including:

- Auto Dealers

- Bars

- Dental Office

- Gas Stations

- Medical Offices

- Pizzerias

- Day Cares

Where in Florida Can I Get East Insurance?

You can purchase East Insurance Group policies anywhere in Florida, including these cities but not limited to them:

- Miami

- Jacksonville

- Orlando

- Tampa

- Tallahassee

- Cape Coral

- Hollywood

- St. Petersburg

- Hialeah

- Fort Lauderdale

- Miami Gardens

- Palm Bay

Are you still confused about commercial property insurance in Florida, or do you need some help with getting a quote for your business? Contact us today and get all the information you need fast and for free!