Commercial Auto Insurance in Florida: Everything You Need to Know

Business owners in Florida who own any business vehicles must have commercial auto insurance to give them protection and coverage in the event of an accident that may arise from property damage or bodily injury.

For instance, the I-95 highway in Florida is among the most hazardous in the US for commercial vehicle accidents like trucks, which is why a commercial auto policy is most needed when operating in Florida.

So what is commercial auto insurance in Florida? Commercial auto insurance covers your damages if a business-owned vehicle gets in an accident. This helps you prevent expensive lawsuits and could save you from bankruptcy or debt. It can cover damages to the other vehicles or properties, medical bills, pain and suffering, and other costs, making auto insurance commercial coverage necessary for Florida companies with vehicles.

Companies that don’t own their vehicles also require insurance coverage for specific uses, including additional coverage for trucks on interstate runs.

What’s the best commercial auto insurance in Florida for you? Read on to learn about ways to find the best coverage and lower your costs.

Why Do You Need Commercial Auto Insurance in Florida?

Suppose you have a small business in Florida that owns a vehicle or vehicles. In that case, you must purchase commercial car insurance because it will protect your business from a potentially costly lawsuit if your commercial vehicles get involved in an accident.

This kind of Florida commercial insurance protects your organization from financial losses due to property damage, liability lawsuit, or loss of income if your business cannot operate without the needed commercial vehicle.

Businesses in Florida with commercial vehicles need commercial auto insurance to protect them from financial losses due to an accident or collision while on the road, making deliveries locally or within the country. Having Florida commercial auto insurance can save your business from losing those hard-earned profits in case of an accident.

There are many small businesses and professions in Florida that can benefit from having business insurance. These professions include:

- Food trucks

- Cleaning services

- Contractors

- Dry cleaners

- Restaurants

- Personal trainers

- Manufacturers

- Landscapers

According to the Florida Office of Insurance Regulation, business owners are required to have commercial auto insurance if they use their vehicles for their operations, including deliveries or transporting goods. Another type of coverage business owners in Florida are required to have is commercial liability insurance.

Read Next: The Complete Guide to Business Insurance in Florida

How Much Does Florida Commercial Auto Insurance Cost?

The median cost of commercial vehicle insurance in Florida is $142 per month (or $1704 per year).

Looking for ways to get cheap commercial auto insurance in Florida? First, you need to understand the factors that impact the cost of your premium. The cost of small business insurance in Florida, including commercials, and business, depends on:

- The industry

- The type of vehicle (a bus, semi-truck, car, cargo van)

- The number of vehicles insured

- Expected mileage for the year

- Claims history

- Your business’s safety rating

- Commercial vehicle driver’s record

When it comes to business insurance quotes in Florida, commercial auto insurance premiums take into account not only the vehicles and drivers but also the type of business, type of driving, distances covered, and the items being transported if any. Even if different trucks cover the same territory, a semi-truck or trailer would have different rates from an urban delivery closed van.

Furthermore, the price of the insurance policy will also depend on where the vehicle routes and whether it be used only locally or interstate. Business insurance auto cost in Florida varies with the coverage and your deductible. Still, the minimum coverage for commercial auto insurance is around $10,000 for bodily injury protection and property damage liability coverage.

If the vehicle weighs more than 26,000 lbs, liability insurance must be added to provide property damage and bodily injury coverage. The minimum insurance policy for liability insurance depends on the vehicle’s weight such that trucks weighing 26,000 to 34,999lbs should have a minimum of $50,000 liability insurance for every occurrence, and for trucks weighing 35,000 to 43,999lbs should have at least $100,000 coverage. In comparison, vehicles with 44,000 lbs. and up must have a minimum of $300,000 liability insurance coverage per occurrence.

In practice, a larger vehicle would carry more cargo and will be on the road for long periods. These vehicles cost more to repair and can cause even more damage in case of accidents.

Business vehicles that travel interstate need to follow the US Department of Transportation policies, which require them to have a minimum coverage of $750,000 in liability insurance for every occurrence. Typically, interstate travel uses semi-trucks, trailers, and large vans.

What Does Commercial Auto Insurance in Florida Cover?

Florida commercial auto insurance is a combination of required and optional coverage. Depending on your needs, your policy could include:

- Bodily Injury Liability Coverage: protects you from loss in case your employee gets involved in an accident that is deemed your fault.

- Property Damage Liability Coverage: covers the costs for repairing a property that employees damage as a result of using the commercial vehicle.

- Collision Coverage: covers losses resulting from a collision in your commercial vehicle.

- Comprehensive Coverage: covers all types of non-collision perils, including vandalism, theft, or other types of damage, for example, if a tree fell on your commercial vehicle.

- Underinsured or Uninsured Motorist Coverage: covers the difference in case your commercial vehicle gets in an accident with a motorist without insurance or who lacks a sufficient amount for the losses.

- Medical Payments Insurance Coverage: covers medical payments for drivers, passengers and others who get injured in an accident

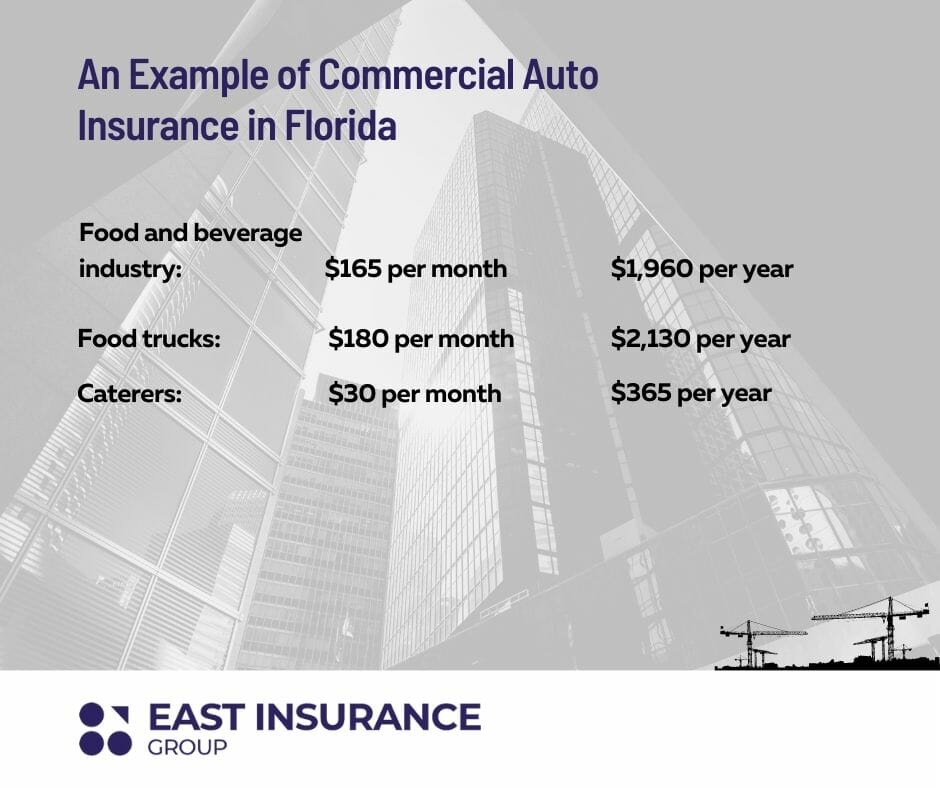

An Example of Commercial Auto Insurance in Florida

Let’s say you are in the food and beverage business. Business owners who need Florida commercial vehicle insurance in this industry are expected to pay about $165 per month or $1,960 per year. In Florida, commercial auto insurance is required for food and beverage businesses that own vehicles, including catering vans and food trucks.

The cost of commercial auto insurance in FL depends on the vehicle’s value and how much your employees drive. That said, food trucks will most likely pay $180 per month or $2,130 per year. On the other hand, caterers will pay $30 per month or $365 per year.

How to Get Cheap Commercial Auto Insurance in Florida

There are a few ways to get the cheapest commercial vehicle insurance in Florida, including maintaining a clean driving record and adjusting your coverage limits and deductibles. As a business owner, you can also get a discount, which is another easy way to get cheaper commercial auto insurance in Florida.

What Policies Must Be Included in Your Commercial Auto Insurance in Florida?

Because one for every ten accidents within the state involves a business vehicle, they need commercial auto insurance. It will help your business significantly in case your vehicle experiences an accident or collision. Find an auto insurance specialist around your zip code to help you look for the most appropriate commercial insurance for your business vehicle.

Some policies you may consider adding to your commercial auto insurance are:

- PIP (Personal Injury Protection) – this type of Florida business insurance will help you cover medical expenses for both the injured driver and passenger in case of an accident.

- Property Damage Liability Insurance – this type of policy will cover the costs for repairing or replacing a third-party personal property damaged during an accident caused by your driver.

- Collision Insurance – this type of business insurance in Florida covers the damage to your company vehicle due to an accident, no matter who is at fault.

- Comprehensive Insurance – this type of insurance can cover the cost of replacing or repairing a damaged or lost vehicle for non-collision reasons such as a tornado, flood, hurricane, theft, falling object, or non-collision fire.

- Uninsured Motorist Insurance – this type of policy offers coverage for medical expenses and property damage for a vehicle accident caused by an uninsured driver.

A commercial auto insurance specialist in your area may offer other optional policies like towing and roadside assistance insurance, rental car insurance, non-owned auto insurance, umbrella insurance policy, or even Bailee coverage. There are instances when additional coverage is required. These coverage options improve commercial insurance protection for property loss or damage to items in your delivery truck.

Commercial auto insurance is essential, especially in this state, as it will save your business from experiencing financial losses due to accidents or collisions. East Insurance Group offers insurance in different cities in Florida, including Orlando, Gainesville, Tampa, Jacksonville, and Palm Coast.

Talk to a commercial insurance specialist to help you find commercial insurance that will fully comply with the laws and requirements. Purchasing the right type of commercial insurance coverage is very important because it will give you the protection you need in case of a collision or accident.

Read More: The Ultimate Guide To Taxi Insurance in Florida

How does Florida Commercial Auto Insurance Work?

In Florida, all vehicles must have a minimum amount of auto liability insurance coverage, regardless of the type of use. These limits are:

- $10,000 in personal injury protection

- $10,000 in property damage liability

Your Florida commercial auto insurance company might recommend higher liability coverage limits depending on the types of vehicles you own and how you use them.

Also, you may need additional liability coverage with your US Department of Transportation of Florida serial number. You can check if you need additional coverage by using your USDOT number with the Federal Motor Carrier Safety Administration.

Common Professions That Need Commercial Auto Insurance in Florida

There are some professions that need Florida commercial auto insurance more than others, including:

- Landscapers

- Contractors

- Food trucks

- Caterers

- Bakeries

- Real estate agents

- Painters

- Rideshare

Where Can I Find Commercial Auto Insurance in Florida?

When you choose East Insurance Group, you choose our experienced agents who will provide you with the information you need and quotes crafted according to your specific needs. You can find us anywhere in Florida, including these major cities:

- Miami

- Tampa

- Orlando

- Jacksonville

- Tallahassee

- Cape Coral

- St. Petersburg

Why Is Commercial Auto Insurance in Florida Important?

Besides the fact that you must carry auto liability insurance according to Florida auto insurance requirements, this type of policy is also very useful because it covers medical bills, damages to the vehicle and property, lost wages, and other related costs that may arise from an accident.

What is the Minimum Coverage for Commercial Auto Insurance in Florida?

In Florida, the minimum amount of coverage required is $10,000 of Personal Injury Protection (PIP) and $10,000 of property damage liability.

What Does Florida Consider a Commercial Vehicle?

A commercial vehicle in Florida is a commercial vehicle operated by a governmental entity. This entity uses special fuel or motor fuel on public highways with a gross vehicle weight of 26,001 pounds or more and has three or more axles regardless of weight or is used in combination in case the weight of the combination exceeds 26,001 pounds gross vehicle weight. This definition can be found in the state’s statutory code.

Owning a commercial business involves many risks that can expose your assets to potential claims or lawsuits, which is why getting commercial coverage is very vital. That’s why you should consider consulting an insurance specialist to guide you on the types of business insurance policies in Florida that can fully protect your company and assets.

Did you find this article useful? If so, you might also want to learn more about Workers Compensation Insurance FL.

Florida Business Insurance FAQ

Florida Commercial Auto Insurance Requirements

According to Florida law, business owners must obtain two types of insurance policies:

- Companies that are not in the construction business must buy workman’s comp insurance if they have 4 employees or more

- Companies that are in construction must obtain workman’s comp insurance if they have only one employee

Do I Need Commercial Auto Insurance if I’m Not Required by Florida Law?

If you use your personal car for business purposes, your activities are probably not covered under your car insurance policy. It is always a good idea to consider purchasing commercial auto insurance if you or your employees are driving the vehicle to conduct business activities, as it can protect you in many cases that were described above.

How To Choose the Right Form of Insurance for My Business?

A risk assessment is one of the best ways to choose the right type of business insurance. Think about the liabilities that may occur daily. Usually, a commercial umbrella policy is a good option for any type of company as it covers many situations that can happen to any business.

If you are still confused about commercial auto insurance in Florida, make sure youcontact our experienced insurance specialist and you will get all your questions answered.