Commercial Truck Insurance Florida: Costs, Benefits, & Requirements

Trucking insurance in Florida is required by state law. It requires local truck drivers and new ventures to have a certain amount of liability insurance anywhere in Florida. But regardless of the requirements, Florida commercial truck insurance is very useful for truck owners and drivers because it protects them from various risks they face during the normal course of business.

Let’s say that the cargo you have been hauling gets stolen. In most cases, you would have to pay for lost cargo. Or, in another case, let’s say you get in an accident and you or one of your employees get injured. As a business owner, you would have to pay costly medical bills or even lawsuit fees. Whatever the case is, commercial trucking insurance in Florida would cover your finances.

So what is commercial truck insurance in Florida? Trucking insurance in Florida is a bundle of vehicle policies that cover your truck in case of an accident. Commercial truck insurance is comprehensive, and it protects you from a wide range of risks.

In this article, we will talk about truck insurance in Florida: what it is, how much it costs and how to lower the costs. We will also cover Florida truck insurance filings, insurance requirements, coverage, who needs it, why you should choose East Insurance Group, and much more.

What is Commercial Truck Insurance Florida?

Commercial truck insurance in Florida is a type of insurance that protects trucks and large vehicles that are used for business purposes, including:

- Garbage trucks

- Delivery trucks

- Tow trucks

- Cement mixers

- Other commercial trucks

Commercial truck insurance in Florida covers property damages and personal injuries, as well as lost and damaged cargo. These policies are especially important if you haul valuable cargo.

Read Next: The Ultimate Guide To Business Insurance in Florida

Who Needs Commercial Truck Insurance in Florida?

The law requires Florida truck insurance. Still, you should also know that if you fall into one of these categories, commercial truck insurance is necessary for you:

- You own a commercial truck

- You use your truck for commercial purposes

- You are a contractor

- You transport people or cargo in your truck

In short, every business that owns a truck and uses it for business purposes should consider carrying commercial truck insurance.

How Does Commercial Truck Insurance in Florida Work?

Basic semi-truck insurance in Florida covers the costs of the other vehicle in case of an accident in which you were at fault. The coverage also includes the damages to your commercial vehicle. In case you need a specialized offer, East Insurance Group offers coverage for many other possible scenarios, such as vandalism, theft, property damages, bodily injuries, and more.

What Does Commercial Truck Insurance in Florida Cover?

Primary Liability Insurance

Primary liability insurance covers bodily injuries and property damages that your truck caused to other drivers or their property.

General Liability Insurance

General liability covers you in case of client or an employee sues you. For example, if you deliver your cargo to the wrong place or one of your load brokers sues you, you could pay a lot of money for the lawsuit fees.

Physical Damage Insurance

Physical damage consists of two parts:

- Collision: Collision pays for the damages to your truck in case you collide with another object or a vehicle.

- Comprehensive: Comprehensive pays for other risks you might face (vandalism, theft, fire).

Motor Truck Cargo Insurance

Motor truck insurance or cargo insurance covers cargo damage while in transit.

Bobtail Insurance

Bobtail insurance covers property damages and injuries to others that you or your employees have caused while the trailer was detached from the truck.

Non-Trucking Liability Insurance

Non-trucking liability insurance covers property damages and injuries caused while the truck was not used for business purposes.

Uninsured Motorist Insurance

Uninsured motorist coverage pays for damages to the truck caused by another vehicle that doesn’t have any or enough insurance to cover the bills.

How Much Does Commercial Truck Insurance in Florida Cost?

The average cost of semi-truck insurance in Florida is $15,522 per year or $1,293 per month.

There are several factors that impact the cost of truck insurance in Florida, including:

- The type of cargo

- Your driving history

- How long you have been in business

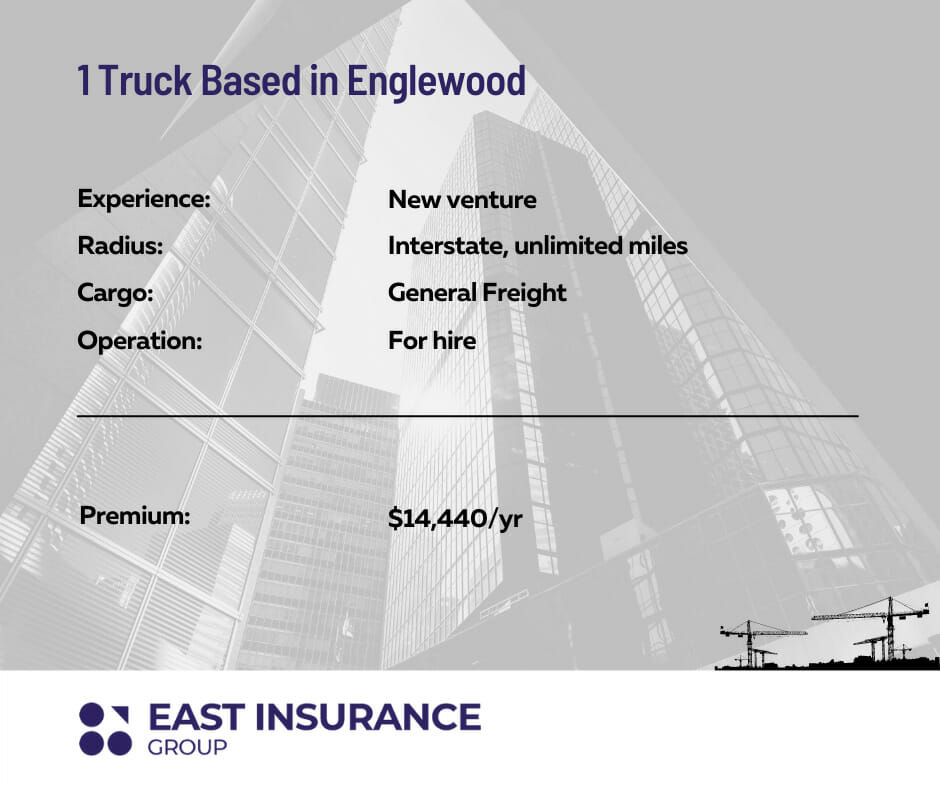

A Real Example of Truck Insurance Costs in Florida

There are several ways to lower the costs of your premium and get cheap commercial truck insurance in Florida, including:

- Keep your driving records clean

- Split up your routes

- Use one insurance company for your entire fleet

- Pay monthly for annual insurance plans

- Pay on time

Florida Commercial Truck Insurance Requirements

According to Florida state law, local truck drivers and new ventures must carry a certain amount of liability insurance. This amount is determined by the type of freight you haul and where you carry it.

For example, if you don’t cross state lines and your truck is over 26,000 GVW, you are required to get an intrastate-only USDOT Number. If you travel out-of-state, you must comply with all the DOPT truck insurance requirements (most federal liability limits are between $750,000 and $1,000,000.

Florida Truck Insurance Filings

Florida state law requires truck owners to submit certain filings to their insurance agent. East Insurance Group will take care of these filings and make sure you fulfill all the requirements. These forms include:

- Form E

- Form H

- The BMC-92

- Form MCS-91

Why Choose East Insurance Group?

Besides taking care of your insurance filings, experienced agents at East Insurance Group will make sure you get a quote that is crafted according to your specific needs as soon as possible. We offer our policies in all cities in Florida, including:

- Jacksonville

- Clearwater

- Cape Coral

- Clearwater

- Miami

- Orlando

- Plantation

- Tampa

- West Palm Beach

- Tallahassee

Handy Florida Trucking Resources

Here are a few resources you may find helpful when looking for truckers insurance in Florida:

- Florida Department of Transportation

- Florida Department of Motor Vehicles

- Florida Trucking Association

- Florida Department of Insurance

What Limit of Insurance is Required by the Department of Transportation (DOT)?

Weight Class of Rig | Florida DOT Requirements |

44,000lbs or more | $300,000 |

35,000lbs to under 45,000lbs | $100,000 |

More than 26,000 but less than 35,000lbs | $50,000 |

Vehicles less than 26,000lbs | State Minimum |

Can You Provide Insurance For 1st or 2nd Year Commercial Driver License (CDL)?

Generally speaking, insurance options for new ventures (1st or 2nd year CDL) are limited. The majority of Florida Trucking Insurance Carriers require two or more years licensed as Commercial Driver License.

In conclusion, commercial truck insurance in Florida is required by state law but it is also very useful when it comes to protecting truck drivers and business owners from many different perils, such as personal injuries, property damages, cargo losses, vandalism, fire, and even lawsuits. So make sure you contact your insurance agent as soon as possible to get the best premium quote!

Are you still confused about commercial insurance in Florida, or do you need some help with getting a quote for your business?Contact us today and get all the information you need fast and for free!

Get A Quote And Get Coverage Today

Our Insurance Specialists are ready to help you out.