Tow Truck Insurance: Everything You Need to Know [2022]

As a tow truck service owner, you love what you do. From popping that elusive Porsche to enforcing No Parking rules, your drivers hustle like no other company.

But a tow truck business is not without its risks, so you should consider having tow truck insurance that includes several different coverage options. You can build a policy that will adequately meet your distinctive needs with these options.

What does tow truck insurance cost? What does it cover? And what doesn’t it cover?

Read on to learn everything you need to know about insurance for tow truck companies.

Want answers to your questions free of charge? East Insurance Group specializes in tow truck commercial insurance and can customize a policy to your needs.

Why Do I Need Tow Truck Insurance?

Commercial tow truck owners and operators are responsible for the well-being of drivers, customers, and the vehicles being towed. They need specialized types of coverage on board to keep the business safe. Not to mention the legal requirement to carry general liability insurance.

Here are some examples of businesses that need commercial tow truck insurance:

- Auto body shops

- Auto mechanical repair

- Roadside service providers

- Rotational towing

- Full-service stations

Read Next: The Complete Guide to Commercial Truck Insurance

How Much Does Tow Truck Insurance Cost?

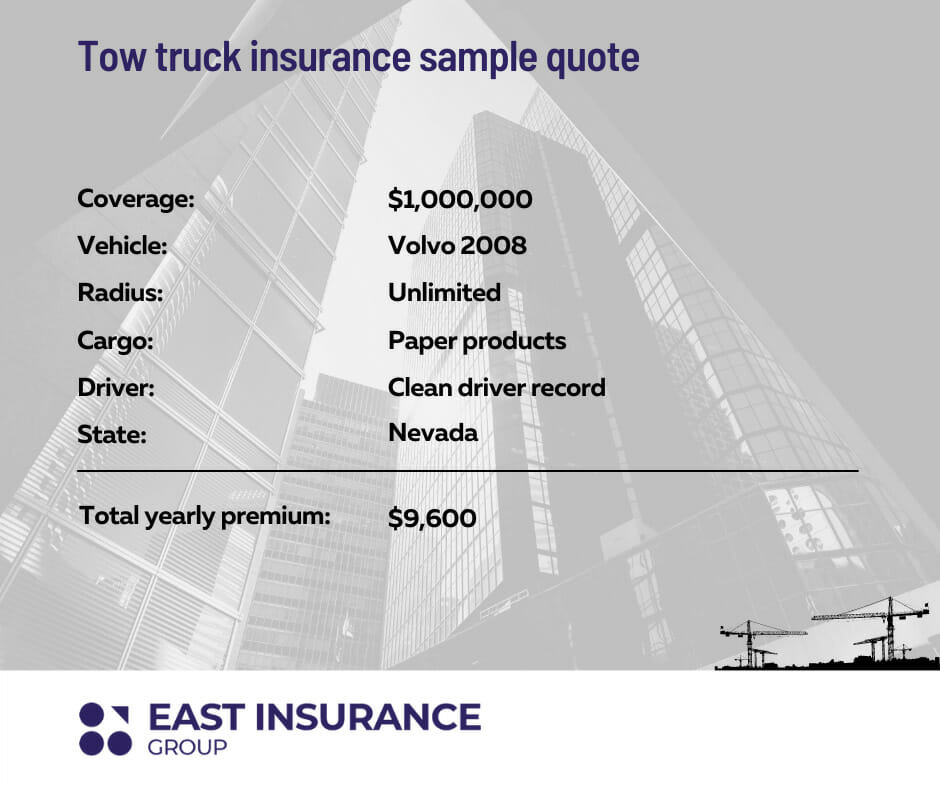

Tow truck liability insurance starts as low as $300,000 and goes up to $1 million. The average monthly cost for tow truck insurance is $450.

Tow truck liability insurance starts as low as $300,000 and goes up to $1 million. The average monthly cost for tow truck insurance is $450.

Every business is different, requiring different coverage to protect itself from risks. Just like your tow truck business is different from the one down the block. When calculating the cost of your tow truck insurance, insurance companies take several factors into account:

- The number of trucks you need to insure

- Your trucks size, age, model, and condition

- The experience and driving record of anyone who will be operating the vehicle

- Your annual coverage and routes you will cover

- The types of loads you will haul

What Doesn’t Tow Truck Insurance Cover?

Some common exclusions to commercial insurance for tow trucks are:

Intentional Damages

Damages or injuries resulting from intentional harm to someone else or property aren’t covered under tow truck insurance.

Damages that Exceed Policy Limits

There is a maximum limit on each insurance policy, and any additional damages beyond the coverage limit are not covered.

Certain Types of Cargo

These include jewelry, alcohol, tobacco, money, explosives, and pharmaceutical drugs.

Towing and Storage Protection

Tow truck insurance often also carries the following coverages:

- Garagekeepers legal liability insurance: Covers your clients’ vehicles when parked on your property.

- On-Hook towing insurance: Covers your clients’ vehicles while you are towing them.

- Tow general liability insurance: Covers you if you are legally liable for bodily injury, property damage, or personal injury that’s not related to your covered vehicles.

Tow Truck Insurance Requirements

According to US federal law, all tow truck drivers must have auto liability insurance, while some states also mandate medical payment coverage. If your tow trucking business has employees, it might be a good idea to invest in workers’ compensation insurance that covers medical expenses for injuries.

What Does Tow Truck Insurance Cover?

- Physical damage – Get your tow truck covered in cases of physical damage. Wrecker insurance will help you repair your tow truck. This protects your vehicle from damage from fire, theft, natural disasters, and vandalism.

- Uninsured or underinsured motorist – If your tow truck gets into a hit and run or a driver who doesn’t have enough coverage to cover the vehicle and medical expenses and is at fault, towing company insurance will cover the extra costs.

- Garage keepers general liability – If a client’s vehicle is parked or stored in your garage or service station and gets damaged, general liability will protect you in cases of fire, theft, vandalism, and collisions.

- On-hook towing– This coverage protects your business if a vehicle gets damaged while towing it. It will pay for repair or replacement costs and includes damages from the collision, fire, theft, or vandalism.

- Medical payments – Tow truck drivers often provide rides for the owners of the vehicles they’re towing. If there is an accident and you, your driver, or the passenger gets injured while in your tow truck, tow truck insurance will provide coverage for medical payments incurred.

- Hired auto general liability coverage – Hired auto coverage will protect the vehicles you lease, hire, rent, or borrow to use in connection with your business. This includes vehicles used for business purposes that are not listed on your policy that you or your employees drive.

- Hired auto physical damage – This tow truck insurance provides physical damage protection on non-owned vehicles such as rentals or leases. This policy will cover the damages if you or your employee get into an accident and damage the vehicle while using it for business purposes.

- Employer’s non-ownership general liability – This will protect you if a private vehicle is used in your business for business purposes and gets damaged in an accident.

Tow Truck Insurance FAQ

What’s the Average Cost of Tow Truck Insurance by Business?

The average cost of tow truck insurance can range from $4,500 to $5000 per year. For example, tow truck insurance in New Jersey is one of the most expensive.

How Do Insurance Companies Determine a Company’s Risk?

The price of towing insurance premium depends on several factors, including your location, your hours of operation, and the types of safety programs you employ.

How Can I Get Cheap Tow Truck Insurance?

There is one way to lower the price of your tow truck insurance and that is to shop around. Talk to insurance specialists, compare prices, and then make the best decision for your business needs.

Your tow truck business is a business that earns income by towing or providing roadside assistance and repair to disabled vehicles, performing repossession work, or operating a repair facility. Tow trucks are the unsung white knights of the road, rescuing stranded vehicles and their owners. There is a lot riding on your tow truck and this added pressure is the reason each one of your tow trucks needs tow truck insurance.

And if you want to know more about similar types of insurance, make sure you read more about our commercial vehicle insurance.

Are you still confused about tow truck insurance, or do you need some help getting a quote for your business? Contact us today and get all the information you need fast and for free!