Commercial Truck Insurance NY: What It Is, Costs, Benefits

The thing about commercial truck insurance in NY is that it can prove to be expensive, no matter how large or small your business is.

As an owner-operator with your own authority, it is up to you to make sure all your resources are insured, including your drivers, trucks, cargo, and your trailers.

Some insurance coverages like physical damage and primary liability are mandatory and unavoidable, while others can be kept at minimum limits.

In this article, you will learn what defines New York truck insurance, how much it costs, the coverage requirements, how it works, and what you can reduce to save money!

What Is Commercial Truck Insurance for New York?

Commercial truck insurance in NY is a group of vehicle insurance policies created according to commercial truck companies’ specific needs for the state.

The policy covers various types of commercial trucks in NY, including:

- Garbage trucks

- Tow trucks

- Cement mixers

- Delivery trucks

There are three types of policies:

Basic Commercial Truck Insurance Policy

The policy covers commercial trucks in New York in case of an accident, and includes a collision and comprehensive coverage.

Specialized Policy

Truck drivers and owners in New York know that piling policies also means higher costs for the trucking company. With specialized coverage, you can insure your trucks without increasing the costs too much.

Nontrucking Coverage

There is also the option to add non-trucking coverage. This option is especially useful when your truck isn’t hauling cargo (for example, occupation accident insurance).

How Does Commercial Truck Insurance New York Work?

As a part of vehicle insurance, commercial truck insurance is specifically created for commercial and transportation businesses. The type of policy you need depends on your business type.

Generally, New York commercial truck insurance covers damages and liability in case of an accident. The policy can also cover cargo and your drivers when they are driving the truck for business purposes.

In most cases, liability limits are around $1,000,000.

Liability insurance for commercial trucks is required in New York. Insurance companies submit filings to the US Department of Transportation. After DOT gets notified about your truck insurance requirements, your authority can be processed.

Some of these filings include:

- Form MCS-96

- The BMC-97

- Form E

- Form H

How Much Does Commercial Truck Insurance NY Cost?

The cost of commercial truck insurance in NY varies from $640 per month (for-hire specialty) and $980 per month (for-hire transport).

Commercial truck insurance quotes in NY depend on several factors, including:

- Coverage requirements

- Driver’s history

- Location

- Cargo

- USDOT authority

- Type of vehicle

- Years of experience

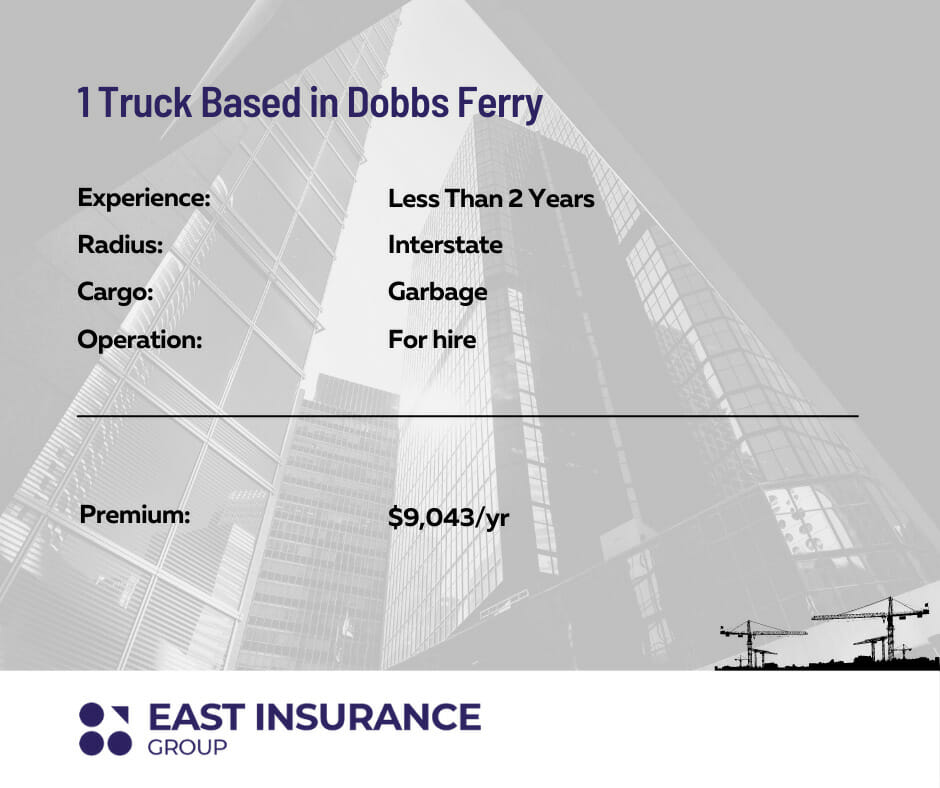

An Example of NY Commercial Truck Insurance

In New York, most annual premiums vary from $9,000 to $15,000. The costs depend on:

- Type of cargo

- Driving history

- How much you’ve been in the trucking industry

Here is a real example of commercial trucking insurance in NY:

What Does Truck Insurance NY Cover?

Primary Liability Insurance

A liability policy is required for all commercial trucks in New York. This type of policy covers bodily injuries and property damages caused by the truck.

General Liability Insurance

While not required by the law, general liability insurance is recommended as it can protect you from various risks that truck drivers face all the time, including:

- Clients falling on your premises

- Delivering cargo to the wrong location

- Lawsuits from unhappy customers

Physical Damage Insurance

This policy covers your costs in case your truck gets damaged. Physical damage insurance has two parts:

- Collision: covers the damages to the truck when it collides with a vehicle.

- Comprehensive: covers other risks, such as fire, theft, and vandalism.

Motor Truck Cargo Insurance

Motor truck cargo policy covers the costs that may result from damages to cargo while in transport.

Bobtail Insurance

Bobtail insurance covers the property damages and injuries your commercial truck caused while the trailer wasn’t attached to the truck.

Non-Trucking Liability Insurance

Non-trucking liability insurance covers the damages and bodily injuries your truck has caused while not being driven for business purposes.

Trailer Interchange Coverage

Trailer interchange covers damages that your truck has caused while driving under a written interchange contract.

Uninsured Motorist Coverage

Uninsured motorist insurance covers the damages to another vehicle in case that vehicle isn’t covered by insurance or the owners don’t have enough insurance to cover the costs.

Workers’ Compensation Insurance

Workers’ compensation insurance covers the truck drivers while they drive for you.

Umbrella Policy

Umbrella insurance covers the potential gaps between your policy and your liability insurance. You can cover these gaps with umbrella insurance without spending too much money.

Commercial Truck Insurance NY Requirements

Commercial truck drivers in New York must have liability insurance.

The amount of insurance depends on the type of cargo that is hauled and the location where it is being transported to. If you don’t leave New York and your gross vehicle weight (GVW) is over 10,000 pounds, your insurance must be:

- Hazmat liability insurance of $5,000,000

- Household goods liability insurance of $300,000

- General freight insurance of $750,000

- Oil transport insurance of $1,000,000

- Vehicle insurance of $5,000 and Catastrophe insurance for the cargo of $10,000

How to Get Cheap Truck Insurance in NY for 2023

Insurance prices have only increased with soaring rates in insurance markets and recurring losses that insurance companies have faced over the last several years. Yet you can follow a few tips to get a relatively inexpensive insurance package for your trucking business.

Package Policy

Bundle together all your insurance coverages into one package from a single company instead of buying each piece of insurance separately, for different time periods and from different companies. Not only is it easier to track and be updated, but it also almost always works out cheaper.

Compare Policy Rates

With so many new insurance companies that have come up and some old-time big companies, you are at a great advantage. Most companies will rate your risks differently and quote different prices. Some companies may even lower their rates for you to improve their business. Take time to get multiple quotes from different companies and see which suits you best. However, be careful if a quotation is unrealistically low.

Make Sure Your Limits Suit Your Risks

If your quotation is really low — significantly lower than what other companies are willing to offer — find out why. It can also harm your business to have cheap insurance because that usually means your coverage limits are really low. In the case of an accident, then, you might have to pay from your own pocket as the limit is low. You should know how much of a risk each of your resources pose and try to get a policy whose limits match those risks.

Ask for Discounts

Many insurance companies offer discounts to customers with good driving records or for new customers. Just ask your representative to lay out what kind of discounts different companies offer and which ones you qualify for.

Increase Your Deductibles

The amount of your deductibles and coverage limits directly affect your premium amount. Consider opting for higher deductibles, and lowering your limits and your premium amount.

Maintain Safe Scores

Hiring experienced drivers with clean driving records, maintaining a fleet of trucks that aren’t too old and don’t require too much-taking care of, and paying your installments on time can really help you with better CSA scores and better credit reports. This will automatically reduce your risks, and insurance companies will offer lower premiums for the same reason.

Raise Your Credit

Maintaining a good credit score or asking your credit card company to raise your credit (so long as you can continue to pay your bills on time and in full) can be beneficial for getting a better insurance policy. Showing that you are financially responsible helps reduce risks that the insurance company will take on your business.

Also Read about: Tow Truck Insurance NY

Getting a Really Low Quote on Your Truck Insurance May Not Be the Best Thing

While there is nothing wrong with finding an insurance policy quote that is really cheap, be very careful and read through your policy entirely.

If your quote is unrealistically low, it could be for one of the following reasons:

- Low Coverage Limits: Not all policies are made to fit you best. One policy might cover your cargo insurance only up to $10,000, while another might cover you up to $25,000. With the former, if you do have a cargo spill and the debris removal bill comes up to, say $19,000, then you will have to pay $9,000 out of your pocket.

- Lack of Vital Coverage: Some policies might be very cheap to buy but may lack some significant coverages. Policies can be bought in packages covering physical damage, primary liability, cargo insurance, bobtail, and non-trucking liability. They may, however, leave out umbrella coverage or general liability. Be sure to ask your representative exactly what is included and left out.

- Misidentification of Your Business: Some insurance companies may even wrongly classify your business category to change your insurance rates and make it appear as a bargain. Scrutinize your policy carefully if the quote is really low.

Why Choose East Insurance Group

When you choose East Insurance Group, you choose an independent insurance agency that carefully tailors policies according to your specific needs.

We provide you with the best level of service, price, and coverage. You can get commercial truck insurance in all cities in New York, and that includes:

- Commercial truck insurance for Buffalo, NY

- Truck insurance for Long Island, NY

- New York City commercial truck insurance

- North Hempstead commercial truck insurance

- Rochester commercial truck insurance

- Yonkers commercial truck insurance

- Syracuse commercial truck insurance

- Ramapo commercial truck insurance

- Amherst commercial truck insurance

New York Trucking Resources

When looking for commercial auto insurance in New York, there are some resources you might find useful, including:

- New York Department of Transportation

- New York Department of Motor Vehicles

- New York State Motor Truck Association

- New York Department of Insurance

The Bottom Line

Hopefully, now you have all the information you need to find the best commercial truck insurance in NY. As a reminder, liability insurance is required for all commercial trucks in New York. Still, other policies we discussed in this article are just as helpful when covering the costs that may occur in an accident.

Are you still confused about the commercial truck insurance requirements, or do you need some help with getting a quote for your business? Contact us today and get all the information you need fast and for free!